Bookkeeping Services: How to Find the Right Bookkeeper for Your Business in 2021

A confirmation email has been sent to your email.

Just like there are many kinds of businesses in need of bookkeeping, there are many kinds of bookkeeping services. In this post we’ll dive into some commonly asked questions about bookkeeping, then explore the kinds of bookkeepers you can hire (and top companies in each category). It’s info you can use to decide what solution makes sense for your company, whether you’re in a startup, medium-sized corporation, or larger.

While we’re happy to provide info and make recommendations, we know you are the ultimate expert on what’s best for your business. This info is intended to help you make an informed decision, not make it for you.

Want to take bookkeeping off your plate? Try Pilot Now.

What Is Bookkeeping?

Bookkeeping involves recording and verifying financial information for your business. There are two kinds of bookkeepers:

- Those who gather financial information, ensure its accuracy, and report on it.

- Those who also handle financial transactions, like sending invoices and paying bills.

In every company, you need someone who can handle both of those tasks. But exactly who performs each task in your business can vary. For many small companies, it makes sense for the business owner to be the person who actually pays the invoices while delegating the info gathering to a bookkeeper.

All bookkeeping involves things like confirming the numbers in your books match the numbers in your bank and verifying that your ledger is ready for your tax preparer. Some bookkeepers will also handle the invoicing and paying of invoices that occurs as part of day-to-day business transactions.

That said, it’s important to have a conversation with your bookkeeper (or bookkeeping service) about what you’re responsible for and what they’ll be handling. That way, none of the bookkeeping tasks necessary for your business to succeed will go undone.

What Is the Difference Between a Bookkeeper and an Accountant?

The main difference between a bookkeeper and an accountant is that accounting is a regulated activity — bookkeeping is not. Both deal with financial information, but bookkeeping only involves record keeping, while accounting involves more strategic planning and analysis of the data provided by bookkeepers.

A bookkeeper sees your day-to-day transactions and makes sure that what you’ve recorded as happening has actually happened. The most important criterion of successful bookkeeping is accuracy. If books are not accurate, it can cause a host of tax and legal problems for that company.

(Aside: This is one of the main motivating factors behind our company, Pilot. We knew if we empowered great bookkeepers with powerful software tools, they could be faster AND more accurate, saving a ton of time for folks from founders to financial teams. You can learn more about how our service accomplishes this here.)

But, typically, a bookkeeper is not empowered to take action based on the info they compile. Instead, the bookkeeper focuses on providing digestible, timely, accurate info to decision-makers within the company.

An accountant is the person who would make recommendations and craft a strategy based on info provided by a bookkeeper. For example, an accountant might prepare the budget for a company, whereas a bookkeeper would break down past spending to inform the accountant while they’re putting together the budget.

Or, consider accounts receivable. A bookkeeper focuses on their accuracy and completeness, while an accountant might look at the data to figure out how long, on average, it takes for customers to pay in full. In turn, that insight could inform company policy.

At smaller companies, an accountant may also do bookkeeping, but rarely does a bookkeeper do accounting. The main reason is that accounting is a regulated, strategic activity, and bookkeeping is not. You must get certified to become an accountant — anyone can become a bookkeeper.

Which Should You Get First, an Accountant or a Bookkeeper?

If you’re a small business or startup with limited resources, it’s more important to get a bookkeeper and make accounting decisions yourself. Knowing that the data you’re seeing is trustworthy — and will hold up at tax time — is fundamental. Without accurate data to review, an accountant can only do so much.

Let’s consider an example using your payroll. Say you’ve been spending a lot on overtime pay, but last month showed a dramatic drop in payroll expenditures. An accountant might see that data and think your employees have gotten more efficient. But a bookkeeper may look at that info and check to see if payroll expenditures were recorded in the correct month. This checking might reveal that you paid your employees for their overtime in a different month than when the work was performed. The bookkeeper would then fix your records so your accountant didn’t make any incorrect inferences based on this info.

How Much Do Bookkeeping Services Cost?

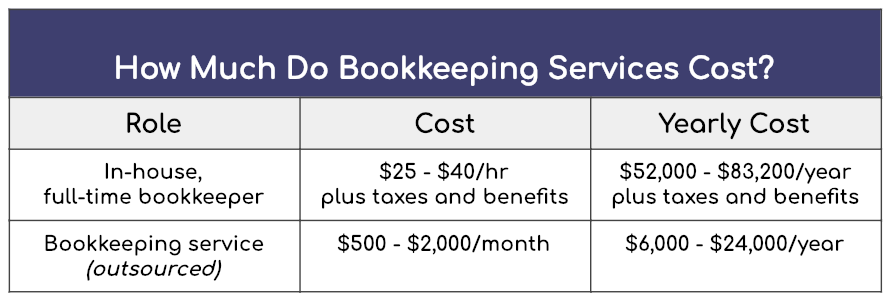

How much bookkeeping services cost depends on how much bookkeeping you need to have done and whether you want your bookkeeper to handle invoicing and payments. Here are some typical cost ranges broken down by type:

In-house bookkeepers are more expensive than bookkeeping services, but they usually handle more functions. Most in-house bookkeepers will handle invoicing and payments. If an outsourced bookkeeping service does that task, they will be on the higher end of the range. Generally speaking, the more human hours needed to handle your bookkeeping, the more expensive it will be.

It’s worth noting here that Pilot’s bookkeeping service starts at $599/month, which is on the lower end of the range we mentioned just now. That’s because most bookkeeping services are human-only, but Pilot leverages powerful software tools to handle the most error-prone calculations involved in bookkeeping. That ensures better accuracy and fair prices (you can learn more about how we do that here).

Are there times when you’ll pay more or less than the ranges mentioned above? Of course. If you have a large business with complex financial interactions or a toolset that’s difficult to work with, you may pay more than the above. And if you’re a very small business with little complexity, you may pay less. But if you’re paying considerably more or less when your bookkeeping needs are average, it’s time to start asking questions — and probably shop for a new service.

Types of Online Bookkeeping Services, with Examples in Each Category

There are four ways you can handle your company’s bookkeeping:

- Hire an in-house bookkeeper.

- Use bookkeeping software and fill in the gaps yourself.

- Hire a human-only bookkeeping firm.

- Use a hybrid service that combines human knowledge and the power of automation.

In this section, we’ll explore the latter two options, along with a quick note on how the accounting software you choose affects how you should pick a bookkeeper.

A Note on QuickBooks Bookkeeping

QuickBooks is by far the most popular bookkeeping and accounting software in use today (and it’s the one we use and recommend to clients). But there are a number of other software solutions — like Wave and Freshbooks — which are popular choices for small businesses and startups.

Before you contract with a bookkeeping service, ask them what software they accept and whether they can facilitate your transition to another software if needed. We’ve had a number of clients who came to us specifically because we do all their bookkeeping in QuickBooks Online. Not all bookkeepers use software that’s easy to transfer from. Bottom line: Choose a bookkeeper who will work with you and the tools you’ve chosen for your company.

Hybrid Bookkeeping Services

To the best of our knowledge, there’s only one service out there that combines powerful software tools with human expertise to provide extremely accurate bookkeeping: Pilot.

Pilot

Price: Scales from $599/mo based on your monthly expenses.

Like most business owners, you probably don’t care what happens behind the scenes as long as your books are accurate, timely, and easy to understand. At Pilot, we’ve automated the most error-prone aspects of bookkeeping, and we use talented bookkeepers to handle the jobs that require a human touch. The result is a fairly priced, yet more effective bookkeeping service.

Pilot specializes in accrual bookkeeping, but we also offer cash-basis bookkeeping upon request. It’s important to note that we don’t handle transactions for you. We make sure your books are beautiful and tax-time ready, but we let you determine who gets paid when.

With the perfect combo of software and people, the accuracy you’ll get from Pilot is second to none.

Examples of Human-Only Bookkeeping Firms

The following are a few examples of bookkeeping services that rely on people to get your books done.

Price: Call for a quote.

Accounting Department offers a multitude of business finance services, including bookkeeping, accounting, and advisory services. Their team is comprised of U.S.-based professionals who form teams around the company’s clients. It’s a higher-cost service that makes more sense for businesses that want to outsource several roles — bookkeeper, accountant, and financial controller, to name a few.

2. Bench

Price: Scales from $139/month based on your monthly expenses.

Bench is popular with small businesses because of its low price and intuitive reporting. However, Bench is not ideal for startups planning to scale aggressively or for larger companies. Why? They only do cash-basis bookkeeping. Additionally, their proprietary software can make it difficult to transition to another software (like QuickBooks) if your company looks to scale.

3. KPMG Spark

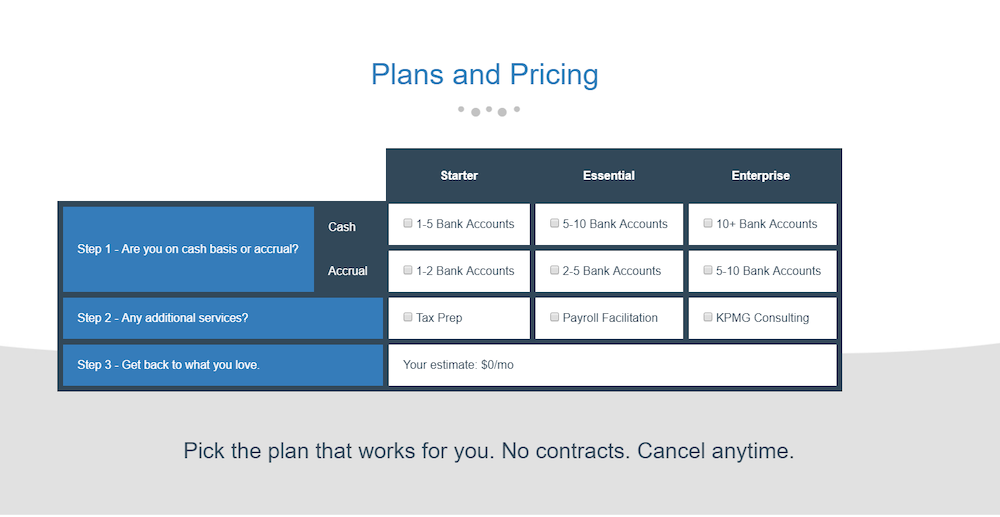

Price: $195+/mo for cash-based; $695+/mo for accrual-based.

KPMG Spark (previously known as Bookly) offers an à la carte menu of bookkeeping services. Their base option includes either cash or accrual-basis bookkeeping, and you can add on tax prep, payroll “facilitation” (note that this is software, they do not execute payroll), and consulting. It’s ideal for companies looking to pick and choose the services right for them, but is less cost effective for businesses using the accrual method.

What Bookkeeping Service Is Right for You?

Cash vs. accrual. Software preferences. Small or large business size. So many factors go into choosing the right bookkeeping service. Hopefully, the information presented in this post has made your choice a little bit easier.

Ready to get your books done right? Try Pilot Now.