Chart of Accounts Examples and Tips to Set Your Finance Team Up for Success

A confirmation email has been sent to your email.

An organized chart of accounts (COA) is the bedrock of sound financial infrastructure. By neatly organizing your financial information, a COA gives decision makers the ability to open up the books and get a bird’s-eye view of their company’s finances.

What’s nice about a chart of accounts is that, for all its importance, it is not that hard to optimize. With expert help and the right software, you can have a perfect COA in a matter of hours.

This post will cover the purpose of a chart of accounts, provide several chart of accounts examples, and discuss why customization is important.

What Is a Chart of Accounts? (And Why You Should Care?)

A chart of accounts is a list of every account for your business, stored in a general ledger. The COA covers all business functions — assets, liabilities, equity, income, and expenses. Pilot product specialist Mark has a great way of putting it: “If you stacked the balance sheet and the income statement on top of each other and stripped away the transactions, you’d have the chart of accounts.”

Each account has a unique reference number that categorizes the accounts according to where they fit on your balance sheet and income statement. The business functions are often broken down by number for easy tracking:

- Assets: 1000–1999

- Liabilities: 2000–2999

- Equity accounts: 3000–3999

- Income: 4000–4999

- Expenses: 5000–9999

A customized and organized COA provides a snapshot of your accounts, simplifying the process of analyzing financial statements.

Think of a chart of accounts like your closet. It’s technically okay to have your pants, socks, and shirts all jumbled together in one big dresser drawer, but it would be a nightmare to find anything. By giving each clothing category its own designated space, it’s easy to see at a glance where everything is when you need to pick out an outfit.

Now imagine a tech company that has an interest in tracking their outsourced development costs. If this information is buried and hard to find because they didn’t organize their chart of accounts (their favorite shirt is hidden under a pile of dirty socks), it unnecessarily burdens the finance team when it comes to preparing an accurate forecast. The more time and resources you spend on tasks that should be simple, the more money you waste.

Sometimes, companies end up with a boondoggle of a COA because they don’t realize their finances can be personalized.

“Businesses need to realize that they don’t have to change their activity to fit a specific structure,” Mark says. “They should change the structure to fit their activity.”

Example Chart of Accounts That You Can Emulate

Checking out how other companies use their COA’s is a great way to get ideas for structuring your own. Here are examples for different types of businesses.

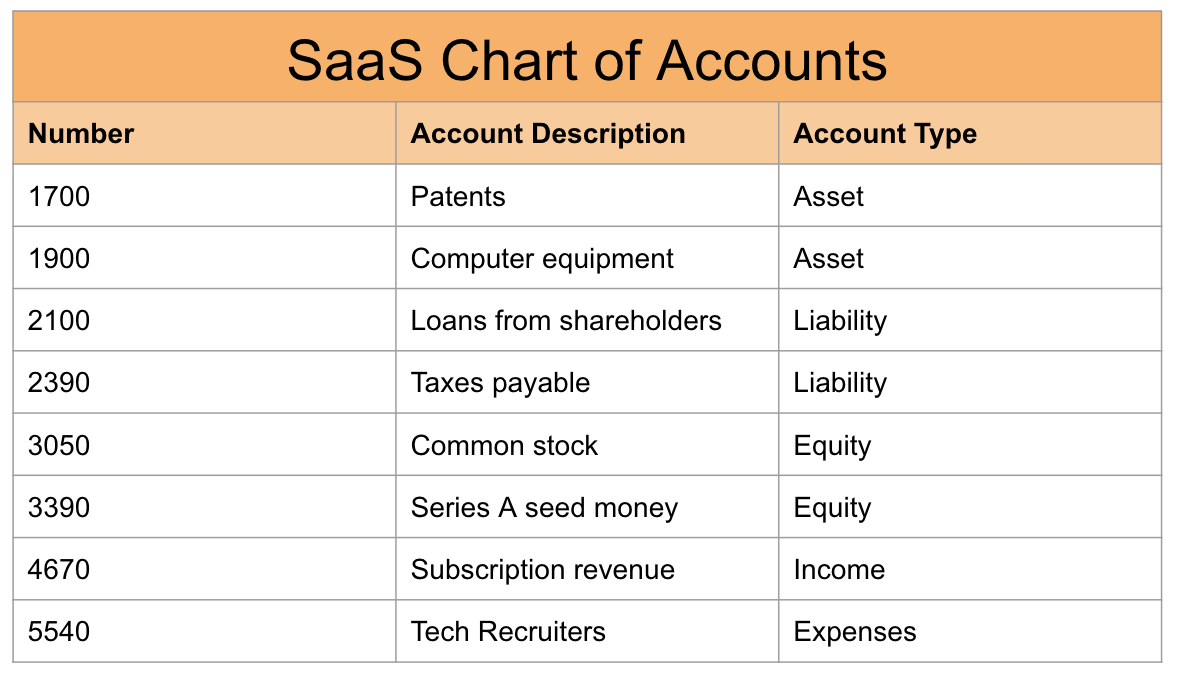

A SaaS company chart of accounts example

Compared with other companies, SaaS (software as a service) companies will want to focus more on areas such as fundraising rounds, subscription revenue, and employee stock options.

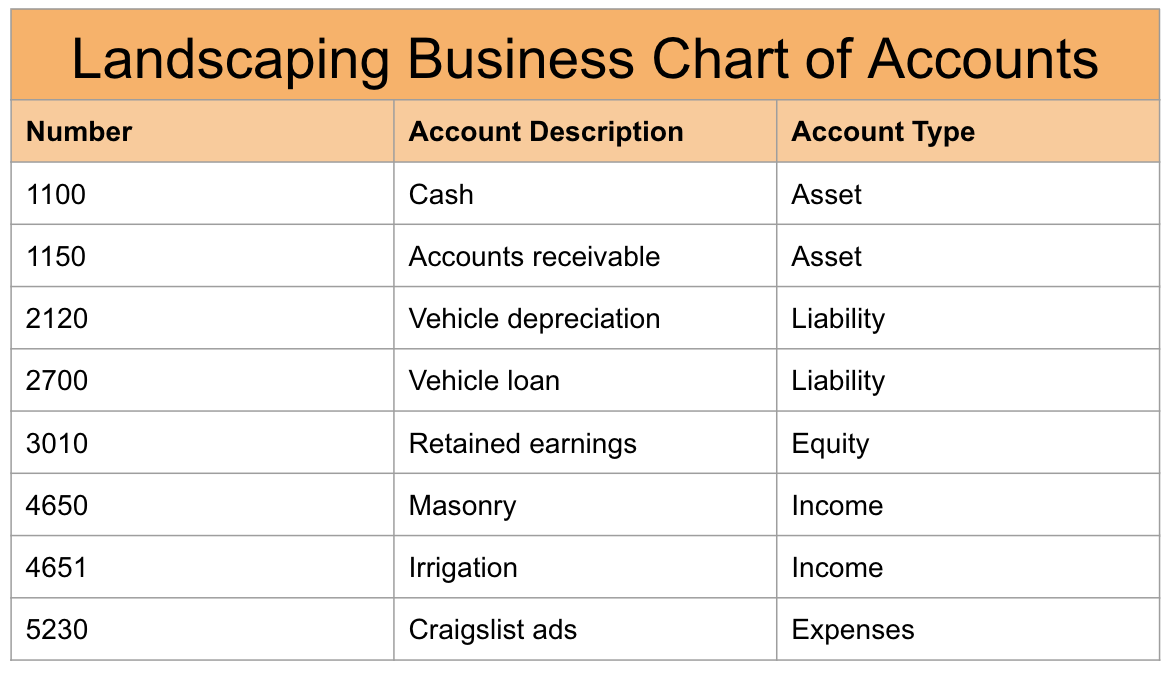

A small business chart of accounts example

Companies of all sizes should focus on the maintenance of their financial infrastructure. It doesn’t take long to figure out what you should be tracking, and by doing so you can save yourself some major headaches come tax time. Here’s how the setup might look for a landscaping business:

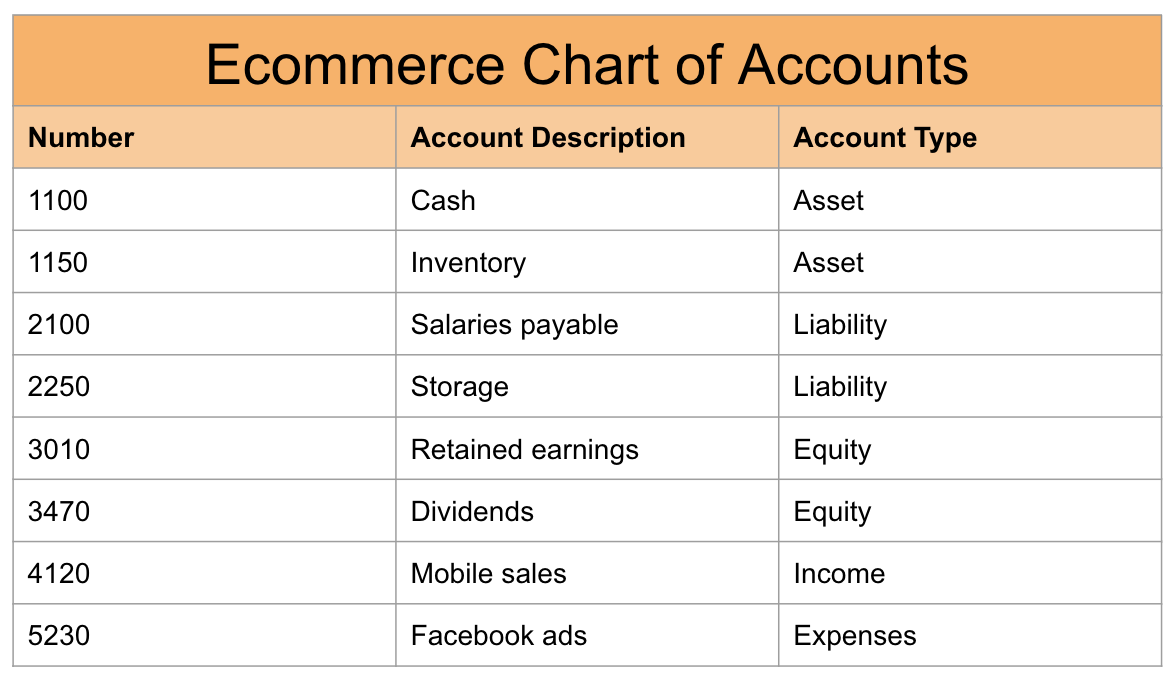

An ecommerce company chart of accounts example

Brick-and-mortar retail continues to lose market share to online shopping, and with that has come a rise in ecommerce companies. Given that those companies are shipping physical goods, they have to closely monitor areas like inventory and storage:

Any of these companies who want to provide a bit more context would break their accounts down into sub-accounts. For example, a checking account could be identified like this:

- Chase checking account::Bank account::Cash on hand

You can break down accounts into sub-accounts so that transactions can be tracked at a more granular level.

Pilot Optimization to the Rescue

If you are struggling to figure out an optimal chart of accounts for your business, Pilot is here to help.

Pilot pairs each new partner with a finance expert. This Pilot team member’s first priority is to figure out how to best structure their chart of accounts.

First, the finance expert gets rid of all of the standard accounts found in QuickBooks. Next, they create a COA with accounts that you will actually use, customized by type of business. For instance, if you run a consulting firm that has billable expenses that you are paying on behalf of a client, Pilot will set up specific accounts to track those transactions.

Pilot also coaches you on how to prune a chart of accounts down to the essentials. It’s common for a COA to become unwieldy and lose its effectiveness. This happens when it fills up with accounts the businesses don’t actually need to track. By uncovering what the customer needs, Pilot can then build a sustainable, and mostly automated, system.

“We work hard to get the context up front, develop rules, decide how we are going to treat things, and then it’s consistent going forward. They have to think about it once and then they’re good to go,” Mark says. “We still check in with the customer monthly, but we only have to ask about three to five transactions instead of hundreds.”

If you ever want to restructure the chart of accounts, Pilot makes the process simple. They work with you to figure out the optimal design, and they ensure that all transactions are automatically sorted into their proper places and reclassified, including past transactions.

Driving Toward Financial Clarity

Imagine if the dashboard of your car displayed every single operation taking place throughout the vehicle. The thousands of data points would be overwhelming. By focusing on a few things that really matter, like speed and RPM’s, the dashboard gives drivers a snapshot of just what they need to know to operate the car smoothly and safely.

The same principle applies to the chart of accounts for a business. When everything is properly set up, analyses of the financials are smooth, and it’s easy to see the data points that are mission critical for your unique operation.

“It’s good for leaders to have their finger on the pulse of their company, but they don’t need to waste time searching around their books. That’s something they can offload to us,” Mark says.

If your financial dashboard is acting wonky for any reason, the experts at Pilot will have it fixed up in no time.