How to file a 1099 form for vendors, contractors, and freelancers

A confirmation email has been sent to your email.

Hiring vendors, contractors, and freelancers can help your business grow and operate like clockwork, especially when hiring new employees isn’t always in the cards.

Though businesses of all sizes must issue 1099-NEC forms to U.S. vendors, contractors, and freelancers every tax year, determining who must get one and figuring out how to get it done can get stressful, especially as tax season approaches.

Apart from explaining how these important tax documents work, we'll also offer some tips that will help you stay organized throughout the year.

What are 1099 forms?

Broadly speaking, 1099 forms — officially known as IRS Form 1099 — outline non-employment income that a company or person earned in a year.

While W-2 forms outline the wages that people earn as employees of a company, along with the taxes that were withheld or paid by the employer, 1099 forms help account for the many other ways in which someone can earn taxable income.

For example, banks and other financial institutions issue 1099-DIV forms to taxpayers who earn through dividends and other distributions, while companies issue 1099-CAP forms to shareholders who receive cash, stock, or other property when a corporation undergoes a change in control or capital structure.

The most common type of 1099 form that businesses issue typically go to U.S. independent contractors, freelancers, self-employed individuals, and sole proprietors who provide some sort of service or expertise to an organization but cover their own employment taxes.

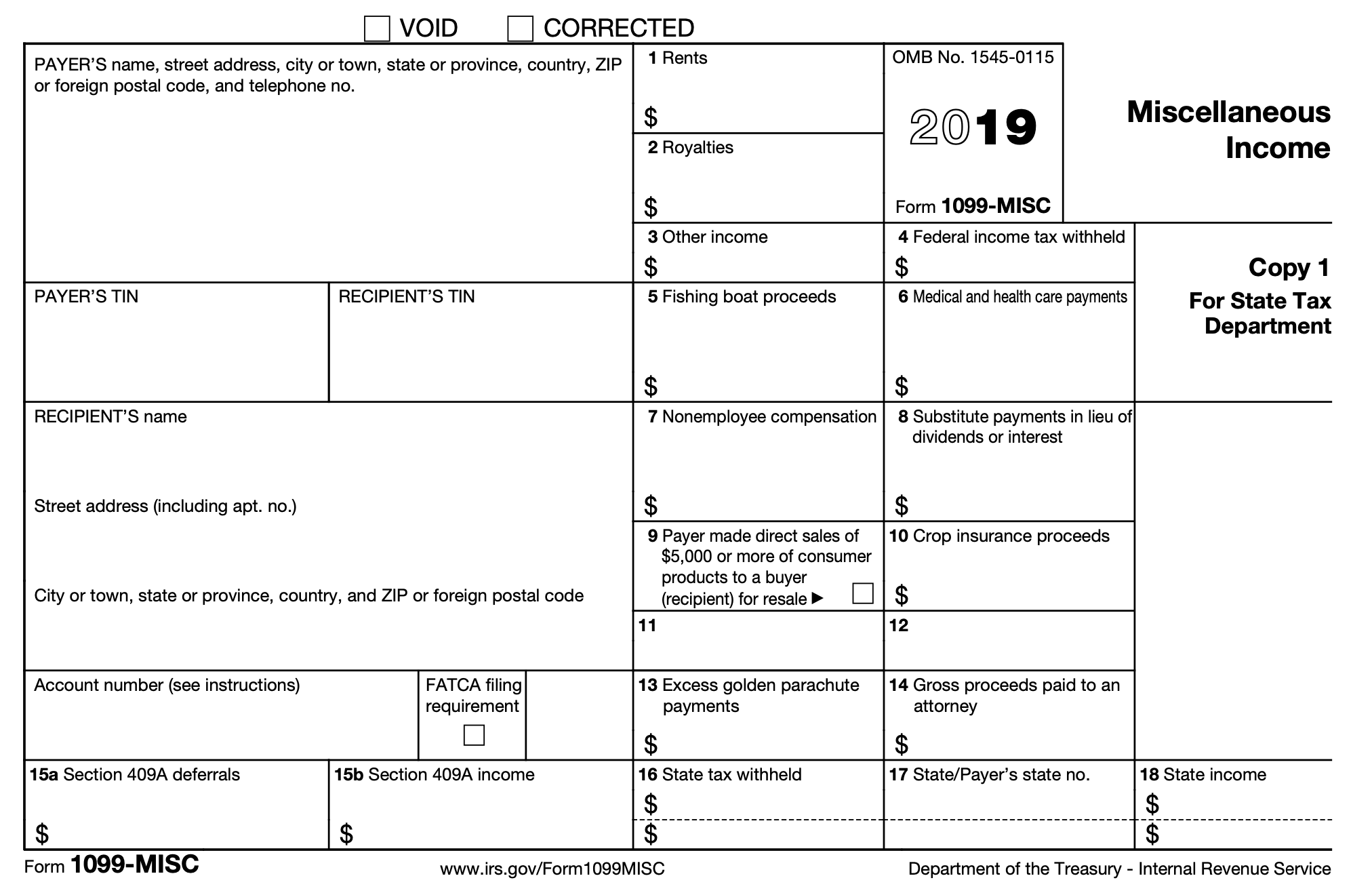

Prior to the 2020 tax year, companies would issue a 1099-MISC form to these vendors that would outline how much was paid out for their services during a specific tax year, along with rent or royalty payments and state and federal income taxes withholdings, among other things.

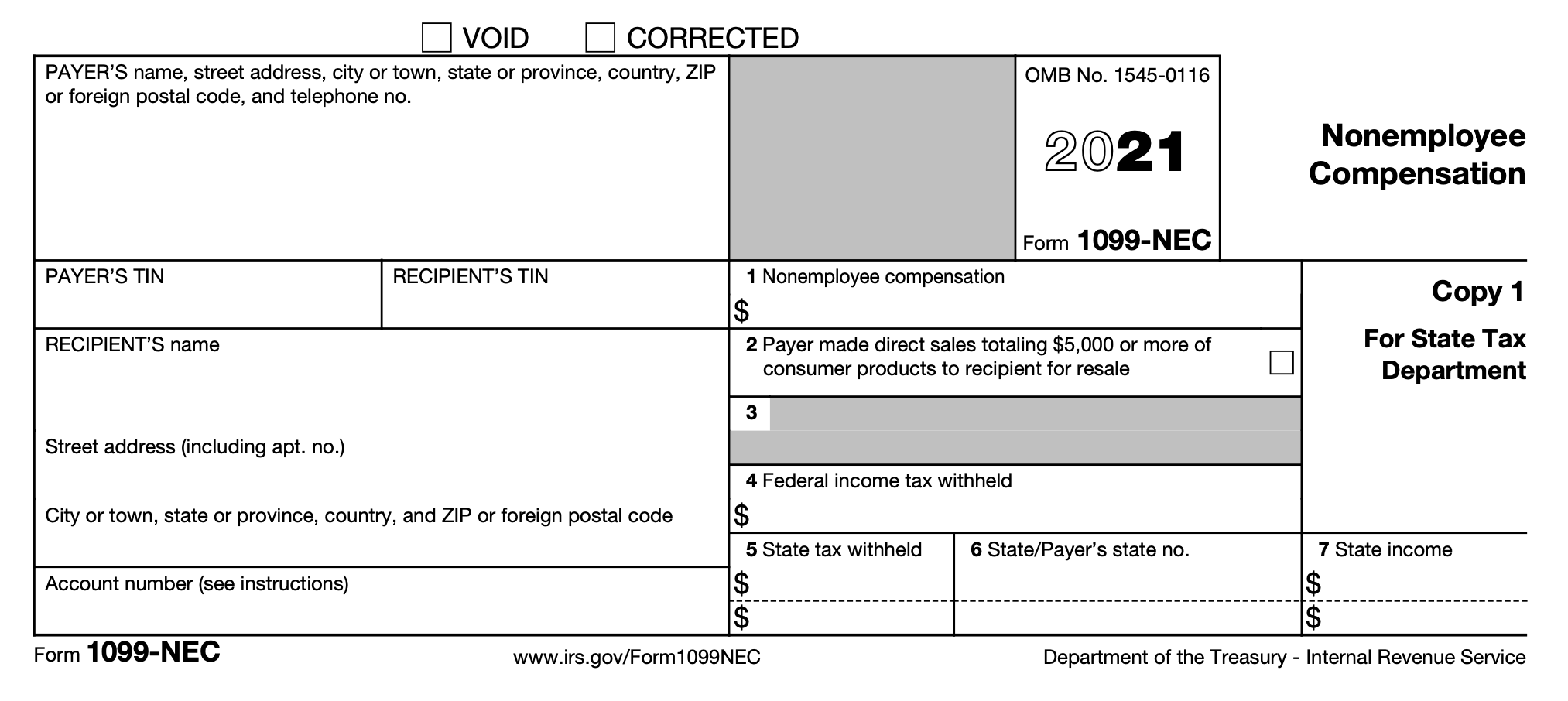

That all changed in 2020, when the IRS revised the 1099-MISC form and instructed businesses to report non-employee compensation using a 1099-NEC form.

However, you should still use the revised 1099-MISC form to report payments for rent and attorney fees that exceed $600 for a given tax year.

Who needs to file a 1099-NEC form?

All businesses are required by law to issue a Form 1099-NEC to relevant vendors, independent contractors, and freelancers, as well as file these same forms with the IRS by January 31. Specific types of vendors covered by this requirement include individuals, sole proprietors, partnerships, and limited liability companies (LLCs).

To properly file a 1099-NEC form, you must have a taxpayer identification number — such as a social security number, employer identification number, or individual taxpayer identification number — for every vendor, contractor, and freelancer.

U.S. Vendors, contractors, and freelancers can provide you with their taxpayer identification number by filling out a W-9 form. For good measure, you should either use payroll providers, such as Gusto, Zenefits, Rippling, and Justworks, or ask vendors, contractors, and freelancers to fill out a W-9 form at the very beginning of your working relationship with them and track payments throughout the year in a dedicated log.

Exceptions to filing a 1099-NEC

Though your business must issue 1099-NEC forms to U.S. vendors, contractors, and freelancers who were paid for services rendered, there are a few notable exceptions in which you either don’t need to file these forms on your own or at all.

If your business paid less than $600 to a vendor, independent contractor, or freelancer throughout the tax year, you don’t need to send them a 1099-NEC form.

You also don’t need to issue 1099-NEC forms for vendors that are C corps, since owners or shareholders are taxed separately from the company.

If you use a credit card, debit card, gift card, or a third-party payment network, such as PayPal, to pay vendors, contractors, and freelancers, the card issuer or payment processor will report those transactions for you, so you don’t need to report those transactions.

Reimbursement processors, such as Expensify, and payroll providers, such as Gusto, Zenefits, Rippling, and Justworks, will often file 1099-NEC forms for you, as long as they were used to pay all of your vendors or contractors. We recommend checking with your payroll provider to confirm.

Best practices for issuing 1099-NEC forms

Issuing W-9 forms, figuring out who needs to get a 1099-NEC form, and keeping track of it all can get really stressful and time-consuming, especially if you’re only getting your ducks in a row right before tax season begins.

The good news is that there are some steps that you can take throughout the year to avoid last-minute scrambles right before key tax deadlines.

- Ask U.S. vendors, contractors, and freelancers to fill out a W-9 form as soon as you start working with them. Taking this step early on will ensure that you have all the information needed to issue a 1099-NEC later.

- Review all bank accounts and other tools, such as Bill.com, for cash, check, direct deposit, and electronic funds transfer payments to individual vendors, contractors, and freelancers that exceed $600 for an entire tax year.

- If you don’t know whether a vendor, contractor, or freelancer needs a 1099-NEC form and what type of entity they are, err on the side of caution and treat them like a potential 1099 recipient. The cost of inadvertently sending a vendor, contractor, or freelancer a 1099-NEC form is much lower than missing one.

- Once you’ve created a list of potential 1099 vendors, contractors, and freelancers, as well as the amount you paid them, share it with your tax preparer, who can file a 1099-NEC on your behalf.

By proactively collecting relevant information you need from vendors, contractors, and freelancers and keeping track of how much they’re paid throughout the year, you’ll be on top of your game once tax season rolls around.

If you’re still searching for tax preparation services, Pilot’s team of knowledgeable and experienced tax professionals are here to help.