How to Read a Statement of Cash Flows (Plus an Example Statement)

A confirmation email has been sent to your email.

When it comes to the amount of cash that’s in your organization’s bank account at any given time, you simply can’t afford to be in the dark about it. Regardless of your revenue, you must ensure that there’s enough cash on hand for your organization to be financially solvent and cover critical expenses, including taxes and payroll.

Your cash flow statement reveals how much money your organization had on hand during certain periods of time. These specific financial statements can also help you identify revenue-generating opportunities or troubling issues that need to be addressed.

In this guide, we’ll give you a better idea of what a cash flow statement is and what it looks like. We’ll also break down the different categories within a cash flow statement and many of the line items that appear in each one.

What Is a Cash Flow Statement?

Your cash flow statement outlines how much money you had on hand at the beginning and end of a specific time period, such as a month, quarter, or year. As its name suggests, cash flow statements also specify where incoming money came from and where you spent it.

In particular, cash flow statements highlight the ebb and flow of money within your organization’s operating, investing, and financing activities. If your organization raised funds, sold shares, or earned interest on investments, those activities will be reported in a cash flow statement.

When the net cash from all the three categories is added up, the net cash increase for the reporting period will represent the true gain or loss of cash in your business accounts at the end of a designated reporting period. Meanwhile, the cash at the end of period should represent how much money is actually in your bank account.

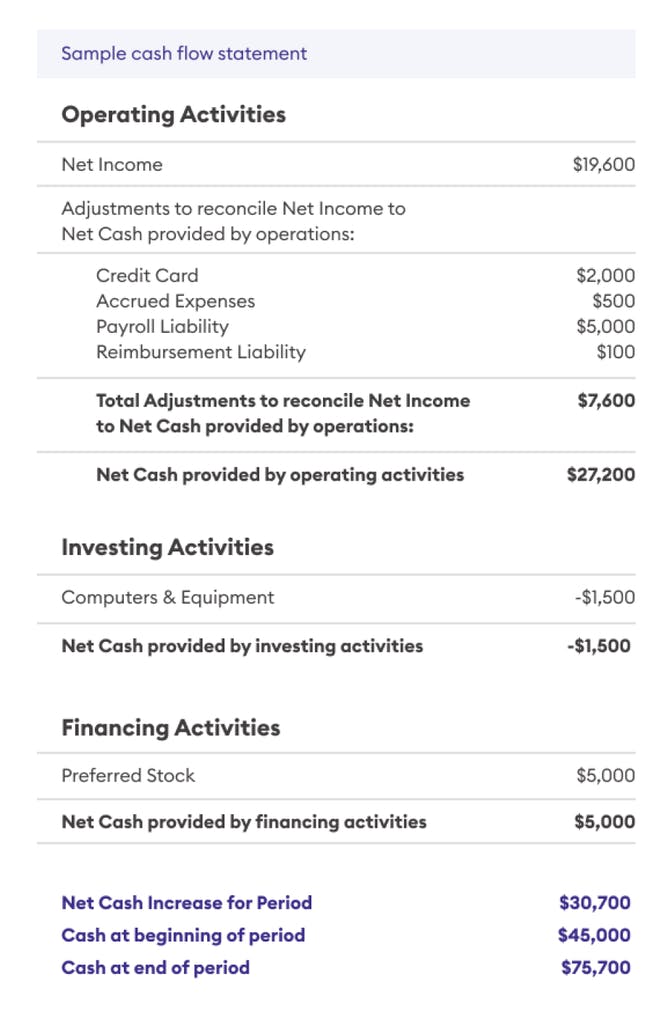

Throughout this guide, we’ll use the sample cash flow statement below to highlight specific sections and explain how they work:

What is a Cash Flow Statement Used For?

Knowing whether your organization is in the black or moving in the opposite direction can help you plan ahead and make informed financial decisions.

Since a cash flow statement highlights how money your organization earned and spent on certain activities during a specific period of time, you can easily see which initiatives were either profitable and promising or costly and potentially concerning.

For startups, the biggest concern is often burning through cash too quickly. You certainly don’t want to find out that your organization’s operations are suffering because there’s not enough cash on hand.

If certain initiatives or activities are consistently generating a noticeable loss over several reporting periods, you may want to re-evaluate current business strategies, determine whether they’re worth the financial risk, and act quickly to turn the tide. For instance, selling assets, shortening the payment window for customers, and trimming or eliminating expenses on underperforming initiatives can not only generate meaningful revenue but also foster more sustainable business practices.

Cash flow statements can also help investors or shareholders assess the financial strength of your organization or determine whether debts can be repaid and managed effectively over time. Apart from determining how much money was brought in, your organization’s actual cash position can be a signal of strength. Investors can get a read on the performance of your product, based on whether people are throwing money at you and paying up front, as compared to having collection issues.

How to Read a Cash Flow Statement

As we mentioned earlier, cash flow statements are generally divided into three distinct categories that represent your organization’s operating, investing, and financing activities. Within each section, individual line items will outline how much money was generated by specific activities or spent on specific initiatives.

For many businesses, the operating activities category in a cash flow statement is the most important one to monitor since it shows how everyday operations affect the amount of cash you have on hand.

Operating Activities

Operating activities represent the money that your organization received or spent to keep your business running like a well-oiled machine, including revenue from sales.

The operating activities section serves as the general starting point for your cash flow statement.

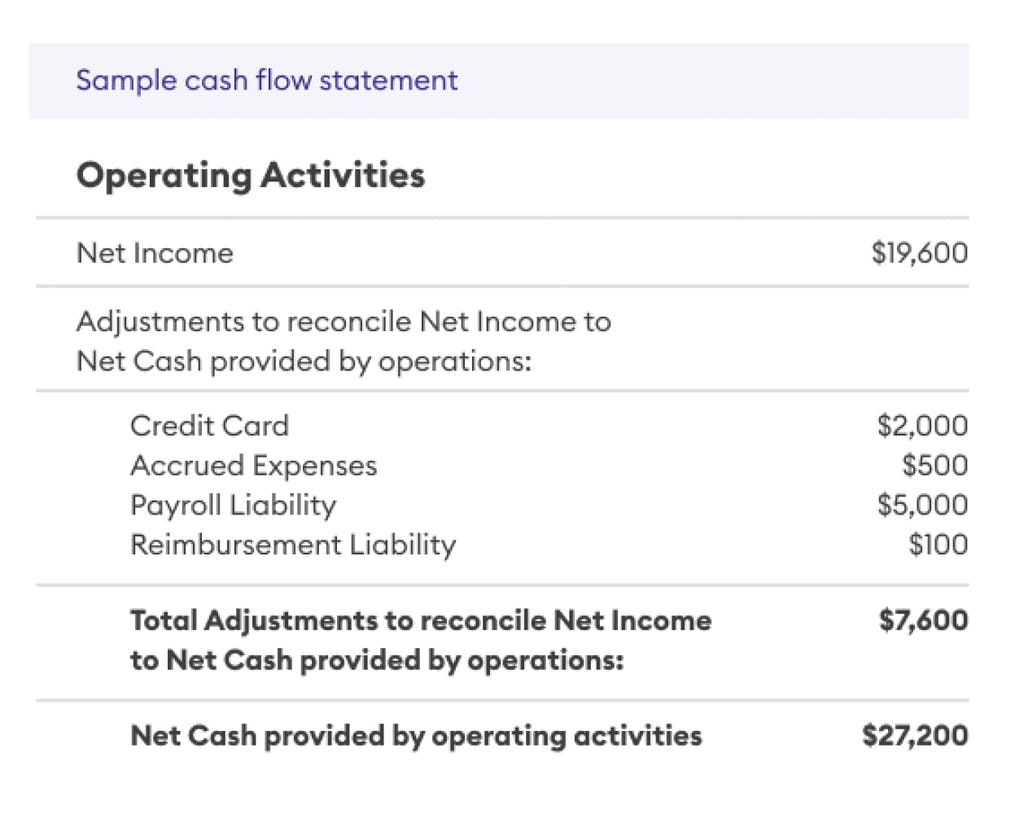

If the indirect preparation method was used to create a cash flow statement, the net income displayed at the top of the operating activities section can be grabbed from your income statement. Using the example above, we already know that SampleCo brought in $19,600 in for the reporting period that’s covered by the cash flow statement.

Adjustments to reconcile your net income to net cash will list impending non-cash expenses — or revenue — that aren’t reflected in your bank account just yet. In SampleCo’s case, we’re seeing money that the company spent but hasn’t paid out yet. More specifically, SampleCo owes $2,000 on their credit card, owes $500 for an unnamed expense, will spend $5,000 for payroll, and owes an employee $100 for a reimbursement.

Although SampleCo will eventually pay all of these expenses, the money set aside for each of these items is still in the company’s bank account at the end of the period covered in the cash flow statement.

Once all of the adjustments to net income are taken into account, everything is tallied up to show the net cash provided by operating activities. For SampleCo, $27,200 in the company’s bank account comes from operations.

Investing Activities

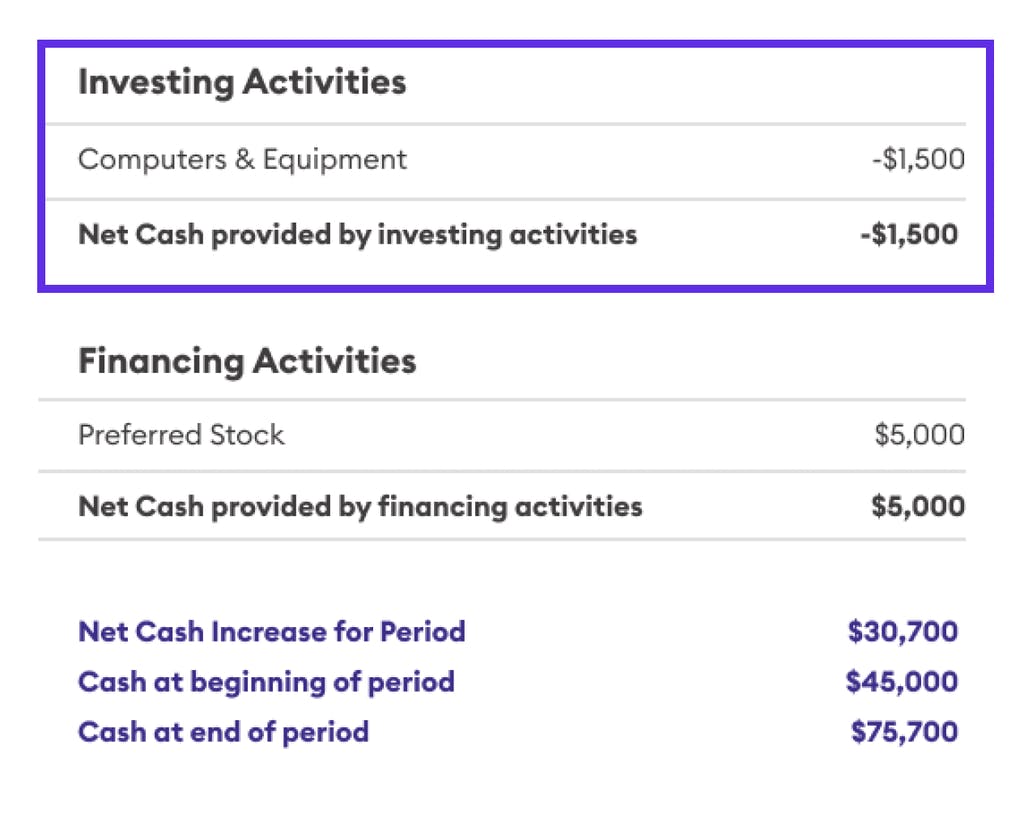

The investing activities category within a cash flow statement, sometimes known as the capital expenditure section, records the cost of investments made by your company. These insights can help you — and potential investors — gauge the overall impact of your company’s investments within a certain time.

It’s worth mentioning that this is money invested by your business. Money invested into your business should be reported in the financial activities section of your cash flow statement.

Examples of reportable investment activities for this section include:

- Buying or selling physical assets, such as computer software, office equipment, or office spaces.

- Buying or selling securities in other companies, such as stocks or bonds.

- Acquiring or merging with another company.

- Proceeds from the sale of subsidiary businesses that were once a part of your company.

Once everything is added up, these investments and earnings represent your net cash flows from investing activities.

Using SampleCo as an example, we can see that the company spent $1,500 on computers and equipment — and paid out the cash for it — during the reporting period covered by the cash flow statement.

Financing Activities

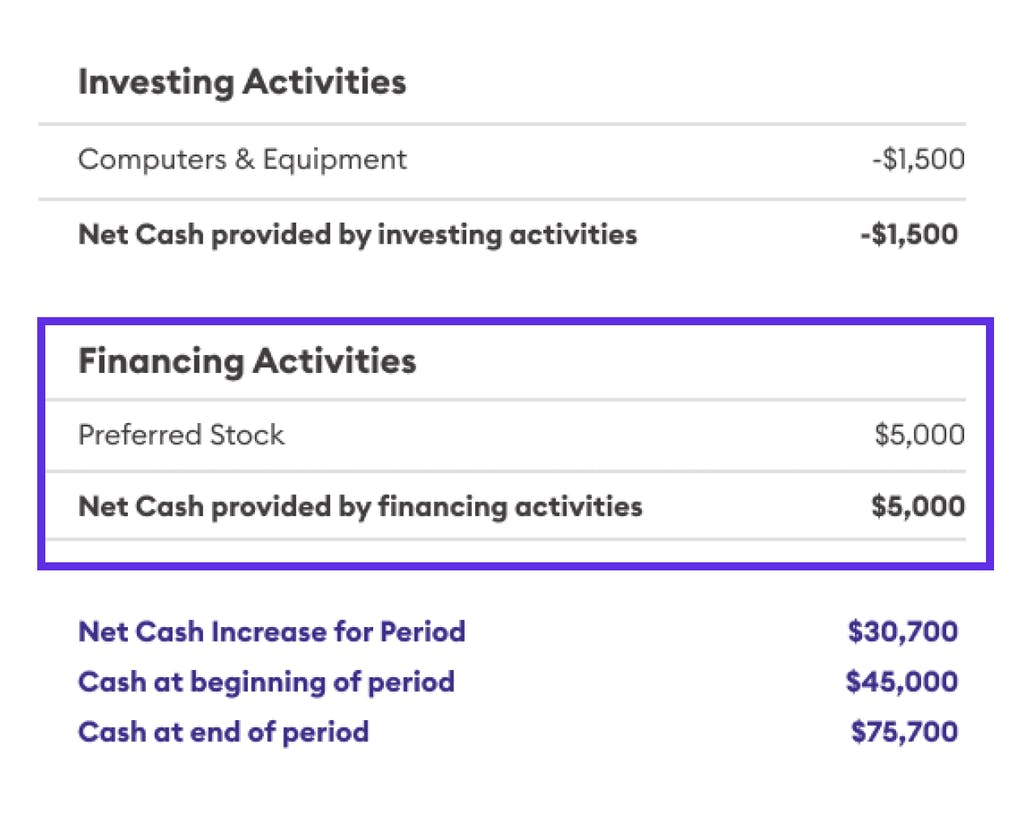

Financing activities, the third and final category of transactions within your cash flow statement, deals with cash involved with borrowing money, managing debt, or raising capital.

This section records transactions related to investments that other people make in your business, such as:

- Taking on or repaying debt

- Repaying or receiving loans from a bank

- Issuing or buying back equity in your company

- Paying dividends to shareholders

After all of these line items are added up, the total amount will be shown as your net cash flows from financing activities.

Insights from this section enable you and potential investors to take stock of your company’s financial health, as well as determine whether your current funding model is sustainable.

When looking at SampleCo as an example, we see that the company raised $5,000 in cash by selling preferred stock.

How to use the cash flow statement with your other financial statements

Closely monitoring the flow of money in and out of your organization over time can help you zero in on opportunities for growth or improvement. Taken together, your three primary financial statements give you the information you need to understand the health of your business.

While the cash flow statement shows you the money you actually have in the bank, the balance sheet and the income statement (also called the P&L) both show you the transactions you’ve made, regardless of whether the money has changed hands yet.

For businesses using accrual accounting, transactions are recorded when they occur. However, depending on the payment terms of the transaction, there may be a delay between when a deal is signed and when the invoice is paid.

For example: say your business makes a sale for $50,000, with net-45 payment terms. That sale will appear as income on your balance sheet and your P&L statement for that particular period. However, you may not actually receive the money for another six weeks. This is where the cash flow statement comes in, showing you that you do not yet have access to that $50,000.

Using the cash flow statement together with the income statement and the balance sheet helps you avoid accidentally creating a cash crunch (which might be a danger if you didn’t realize the money wasn’t available yet). It also helps you track how well your AR is functioning. If you have a lot of income listed on your other financial statements that isn’t materializing on your statement of cash flows, you may need to work on your collections.

We’ve also created a comprehensive guide on what to do after you’ve founded a tech startup. Although the guide explicitly addresses tech startups, you can still use it to better understand what your three primary financial statements are revealing and how they work together.

Regardless of whether you’re starting your first business or have been in the driver’s seat for a long time, understanding and managing finances is key to your success. The cash flow statement is an important tool to keep your business running smoothly.

Pilot gets you accurate, on-time financial statements each month, and helps you understand how your financial data can help grow your business.