Independent Contractor vs. Employee: A Detailed Breakdown of Costs, Facts, and Business Needs

A confirmation email has been sent to your email.

This article discusses the practical specifics of hiring, paying, and working with both employees and contractors — so you can choose the right option based on your business needs. We’ll cover all the specific factors you should consider when hiring employees and contractors:

- The difference between independent contractors and employees (plus: why it matters)

- A detailed breakdown of the costs of hiring each

- Situational reasons to choose one over the other

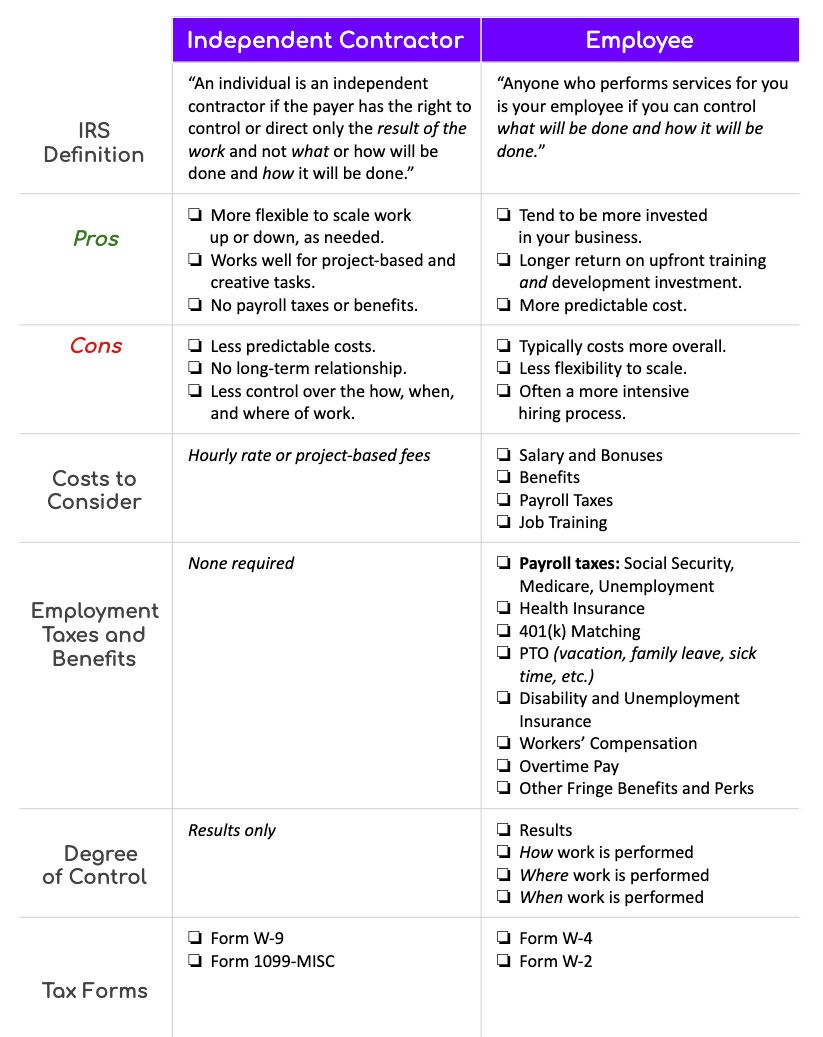

For a quick overview, you can reference the independent contractor vs. employee chart below.

Note: Want to know how hiring contractors or employees affects your books? At Pilot, we have a team of expert bookkeepers using unique tools to automate the most error-prone aspects of bookkeeping. If you want a better financial picture of your business to make informed hiring decisions, Try Pilot Now.

What’s the Difference Between Independent Contractors and Employees?

In some situations, a working relationship can blur the line between independent contractor and employee. But the distinction is really important for your business to get right.

According to the Internal Revenue Service (IRS), a worker is an employee if:

You can control what will be done and how it will be done. This is so even when you give the employee freedom of action. What matters is that you have the right to control the details of how the services are performed.

A worker is considered an independent contractor if:

The payer has the right to control or direct only the result of the work and not what will be done and how it will be done.

In both definitions, the idea of control is the primary distinction between a contractor or employee. The IRS breaks their criteria down into three categories:

- Behavioral Control: Do you decide how, when, or where a worker does their work?

- Financial Control: Who decides on payment terms and methods—you or the worker?

- Type of Relationship: Employment agreements, contracts, and the length of time you’ve worked together all help the IRS determine this.

You’ll also need to consider your state’s regulations about what constitutes a contractor vs. employee. Many states use the federal designation as a start, then consider how economically dependent the worker is on the company as a further test.

Why the Distinction Matters

There can be a lot of ambiguity between independent contractors and employees. That’s why even the IRS says the distinction comes down to the specific facts in each individual case.

Some companies attempt to take advantage of that ambiguity by classifying legitimate employees as contractors—to avoid paying employment taxes and having to provide benefits. Because of that bad behavior, federal and state tax authorities are strict about what constitutes a contractor.

For an example, look no further than Uber. They settled a labor dispute in early 2019 by agreeing to pay out $20M to affected drivers, after six years in court. The lawsuit claimed their “independent” drivers are actually employees because of the degree of control Uber exerts over how, when, and where they work.

Since we aren’t CPAs or lawyers, we can’t give you specific advice on whether someone you’re working with should be classified as an independent contractor or employee. If you’re uncertain about someone’s classification, here are a few resources that offer more information about federal and state classifications:

- Understanding Employee vs. Contractor Designation│U.S. Internal Revenue Service

- What You Need to Know About Hiring Independent Contractors│LegalZoom

- Employees and Independent Contractors│Nolo

- State Department of Labor Offices│U.S. Department of Labor

- Form SS-8: Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding│U.S. Internal Revenue Service

Costs of Hiring an Independent Contractor vs. Employee

When you look at the average costs of hiring an independent contractor or a full-time employee, it’s tempting to think, as a rule, that one type of worker costs more than the other. The reality is a little more involved than that. There’s no hard-and-fast answer, and it’s difficult to compare the costs side-by-side.

Note: Some people think that part-time employees are a happy medium when it comes to costs. That said, requirements around part-time workers vary widely from state to state—so if you’re considering that route, we recommend talking to an employment lawyer or other business professional to learn more about your obligations.

Breaking Down the Costs of Each Worker

So how do you figure out which option makes sense for you financially? To start, take a look at the type of costs that come with hiring contractors and employees.

For independent contractors, it’s often straightforward—you pay them an agreed-upon hourly or project-based fee. While there can be some variation in your final bill, most of the time you know what to expect.

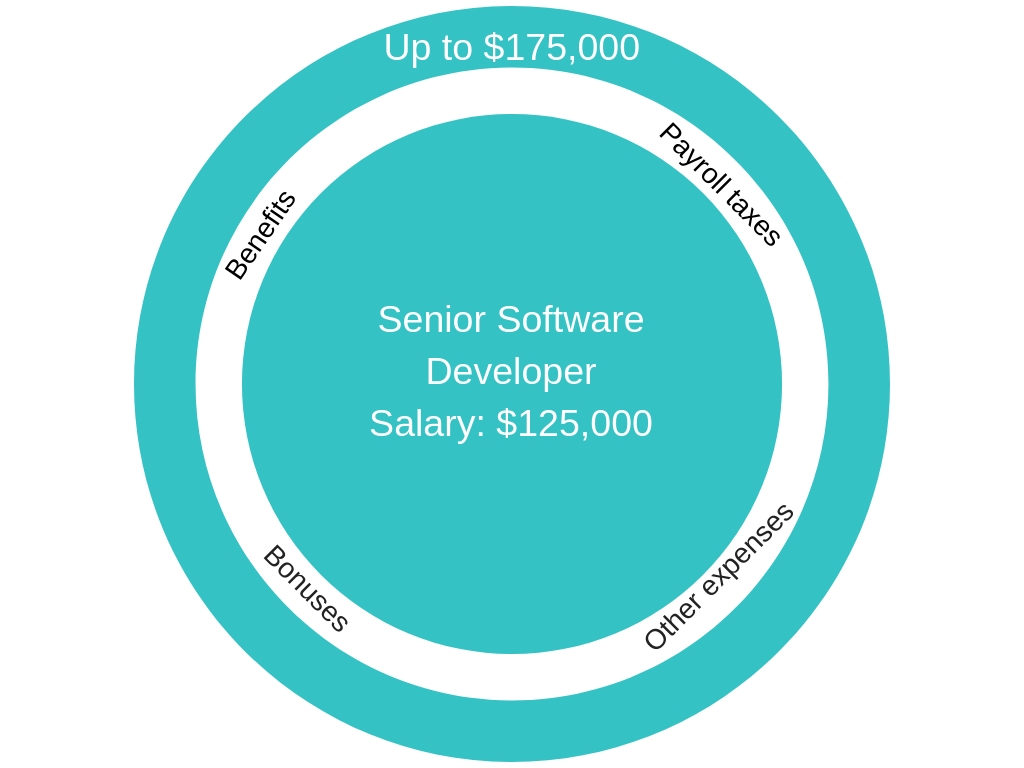

A lot more goes into hiring a full-time (or common law) employee. There are myriad costs, including:

- Salary and bonuses

- Benefits (more on those later!)

- Payroll taxes

- Job training

MIT estimates the true cost of an employee is 1.25 – 1.4 times higher than their salary. So if you hire a full-time senior software developer for $125,000 per year, you can expect to pay between $156,250 and $175,000 total for that employee.

To see how benefits and taxes add to the total cost of an employee, take a look at the QuickBooks Employee Cost Calculator. You can input the specific benefits you plan to provide along with base pay to determine roughly how much that plan would cost you.

Comparing Costs by the Hour

You can also break the costs of each type of worker down to an hourly rate—that’s your best bet for comparing apples to apples on the financial side.

- Using resources like Glassdoor and Indeed, find out the average salary in your area for the job role you need to fill.

- Using the QuickBooks calculator or MIT’s ratio above, calculate the true cost of an employee.

- Then divide that number by 2,080 hours per year (for a full-time employee—that’s 40 hours a week, for 52 weeks in a year).

Going back to our Senior Software Developer example from above, it looks like this:

$175,000 / 2,080 hrs = $84.13/hr

Once you know how much a full-time, salaried employee costs per hour, you can look for quotes from contractors with a similar level of experience and see how they compare.

Do Employees Always Cost More?

While it may seem like it always costs more to hire an employee, keep in mind that many contractors pay for their own self-employment taxes and benefits. That means the fee you pay for their work may actually be higher than the hourly rate you’d pay a full-time, salaried employee.

Not to mention, good contractors charge higher rates. If you base your search on contractors who cost less than an employee (based on an hourly rate), you have to take quality into account. If you only need a few projects done, a high-quality contractor is still less expensive than an employee in the grand scheme of things. But if you have many projects in mind, an employee may not cost more after all.

Employment Taxes, Benefits, and Other Expenses

Speaking of taxes and benefits, let’s dig into what you’re required to pay versus advised to pay for employees.

The first cost is employment and payroll taxes. You’re required to pay Social Security and Medicare taxes (FICA) and unemployment taxes (FUTA and SUTA) —and you’re also responsible for withholding the employee’s portion of income taxes and remitting it to the appropriate tax agency.

While the actual cost of payroll taxes will vary, it’s important to note that running payroll and remitting those taxes is a complicated process. You’ll need a software solution or an accounting professional to help. If you can’t afford to build out the infrastructure managing payroll requires, then you really can’t afford an employee, even if salary and benefits seem manageable.

Note: At Pilot, we offer super-accurate bookkeeping services to our clients. Many of those clients use Gusto to handle payroll. It’s one of 14 tools that we always recommend to our clients.

Beyond salaries and hourly pay, benefits are the biggest cost of hiring an employee. For reference, federally mandated benefits include:

- Health insurance

- Overtime pay

- Unemployment insurance

- Worker’s compensation insurance

- Unpaid, job-protected family and medical leave

Additionally, your state or city may require you to offer additional benefits, including:

- Dental and vision insurance

- 401(k) plans and contribution matching

- Paid time off (including vacation, sick leave, and family leave)

- Disability insurance

Many of these benefits are commonly offered to employees throughout the U.S. — even where they aren’t required — along with other fringe benefits and perks (like commuter benefits or professional development stipends).

Other expenses you may encounter in hiring full-time employees can include the cost of recruiting, job training, and ongoing training and development.

Employee Relationship and Type of Work

Costs aside, there are some situations clearly more suited to an independent contractor versus a full-time employee. Here’s a quick look at situations that may affect your choice.

Independent contractors can be a good solution if the work you need done is:

- A short-term project (like a new product launch or a website redesign)

- Specialized and transactional (you won’t need to coach the contractor through each step)

- Outside your core business offering

Because of that, independent contractors are most often hired to do work like building your website, writing your blog content, and handling administrative tasks. They may also be ideal for seasonal work, but that really depends on how much control you need to have over their work process (more on that below).

On the flipside, a full-time employee can be a better option if the work is long-term and ongoing, central to what your business does, and highly collaborative. Employees can handle multiple projects at the same time and you don’t have to get them up to speed before each and every undertaking. That, in itself, can make employees more cost (and time) effective in the long-run.

Degree of Control: How, Where, and When Work is Done

Both natural logistics and the IRS regulate how much control you can exert over employees and independent contractors. While control may seem cut and dry, it’s a really important consideration to factor in before you choose between an independent contractor or employee. Otherwise, you may exert too much control over how a contractor works and end up in hot water with the IRS or the Department of Labor.

The general rule is this:

- When working with contractors, you can specify the end product and a deadline for it. You can’t mandate things like where a contractor works or the hours they keep.

- When working with employees, you have much more control over how, when, and where that work gets done.

That’s part of why highly collaborative work tends to be done by employees—because you can mandate they come into the office and work the same hours as the rest of your team.

On the other hand, asking that of employees means you’re responsible for providing them the tools to work in that way, including office space, computers, and training. That can drive up the ultimate cost of hiring someone.

Independent Contractor vs. Employee: Which is Right for You?

See what we mean about a simple answer? Which type of worker makes sense—both for your business in general, and for each individual role you need filled—depends on many factors.

It all comes down to taking an honest look at your budget and your current and future projects. With some time, research, and thought, you’ll be able to determine the right type of worker for your unique situation. Hopefully this post helped you kickstart the process!

Note: Want to know how hiring contractors or employees affects your books? At Pilot, we have a team of expert bookkeepers using unique tools to automate the most error-prone aspects of bookkeeping. If you want a better financial picture of your business to make informed hiring decisions, try Pilot.