MRR vs. ARR: How to Measure SaaS Subscription Revenue

A confirmation email has been sent to your email.

If you run a SaaS company (or any other business that receives subscription revenue), you can estimate how much revenue will be coming in over time and create accurate revenue projections that are closely tied to customer growth.

But is it better to track and monitor progress based on the amount of subscription revenue that comes in every month, or every year?

The answer depends on how your subscription model is structured and how your business is growing. There are also a few key caveats that you should keep in mind as well.

We’ll help you zero in on the right metric that can help you monitor, gauge, and forecast subscription revenue over time, as well as point out a few considerations that should be factored into your decision.

What is the difference between MRR and ARR?

While MRR and ARR measure the amount of subscription revenue that flows into your organization, the main difference centers on time.

What is MRR?

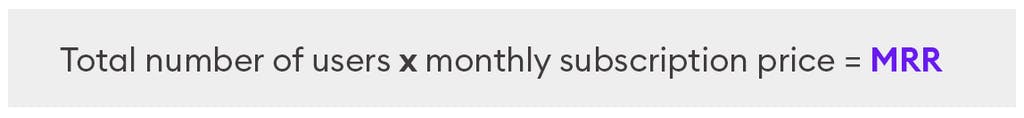

MRR, or monthly recurring revenue, is the total amount of money brought in from subscriptions during a single month. This amount can be calculated by multiplying the total number of users or customers by the price of a subscription for any given month.

Example: Let’s say you have a $12 monthly plan that allows customers to access more of your products or services. If there are 11 customers who are paying for this plan during a specific month, your MRR would be 11 x $12 = $132. If nothing changes, this means that you can expect to get $132 of revenue each month.

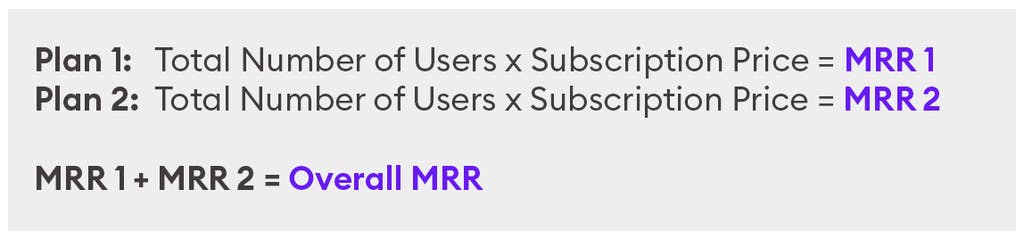

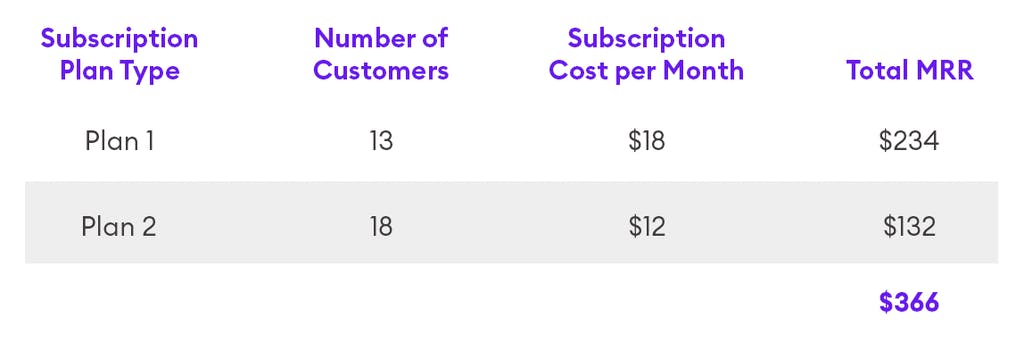

If your business offers several plans at different subscription price points, simply calculate the MRR for each one and then add the subtotals together to get your overall MRR. When calculating the MRR for each plan, make sure that all of your data is from the same month.

Example: Using the same scenario as before, let’s now assume that your business also offers an $18 monthly premium plan. At this point in time, if 13 customers are paying for the premium plan, calculate the MRR by multiplying the number of customers by the price they’re paying — this will give you $234. Since we’ve already determined that the MRR for the cheaper plan is $132, add it to the MRR for the premium plan to calculate how much subscription revenue came in for a specific month — in this case, it’s $366.

What is ARR?

ARR, or annual recurring revenue, refers to all of the money that subscriptions yielded over the course of a year.

ARR assumes that the same amount of subscription revenue should come in the following year if there are no changes to your business – meaning if no more customers signed up for your services, cancelled their subscriptions, upgraded to a more expensive plan, or downgraded to a cheaper one.

Example: Let’s say you have a one-year, $45 plan for enterprise customers who need more flexibility and support when they use your products or services. If 15 customers sign up for this plan during a specific year, then your ARR for that time will be $675.

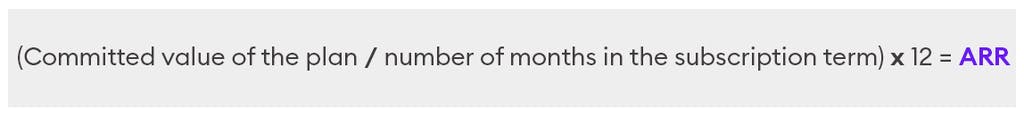

Even if your company doesn’t offer annual plans or subscriptions for customers, you can use recurring revenue from monthly, quarterly, and half-yearly plans to calculate your ARR. This can be done by dividing the total committed value of the plan or contract by the number of months in the subscription term and multiplying by the 12 months in a year. This is also called annualizing the recurring revenue.

(Committed value of the plan / number of months in the subscription term) * 12 = ARR

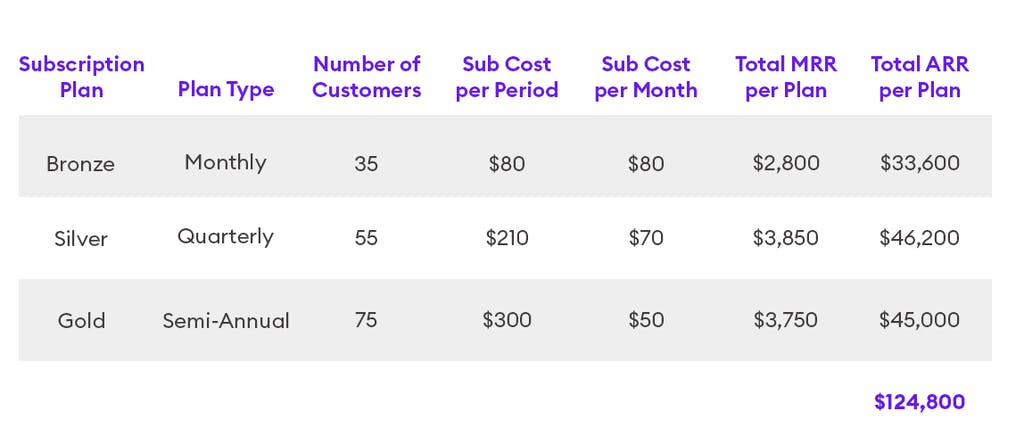

Example: Let’s say your company offers customers three different types of plans, with 35, 55, and 75 customers signed up for each respective type. The calculation for your total ARR would come out like this:

How to Use MRR and ARR

MRR and ARR can be helpful for different reasons. ARR helps you plan on a macro level for the future by offering an understanding of how your revenue has grown over time and how much it could continue to grow. MRR, meanwhile, allows you to see on a micro level how much subscription revenue has grown over the past month or quarter and compare these results against those from similar time periods.

In short, ARR is useful for overarching revenue goals while MRR is useful to track short-term progress on the sales and marketing front.

All of this may sound straightforward, but calculating your ARR and MRR can get a bit complex, especially if you offer a variety of subscription plans for customers and run a variety of revenue-generating initiatives throughout the year.

Should I use MRR or ARR?

Since customers are likely more amenable to a plan that bills them every month and gives them more flexibility to cancel, MRR is the seemingly logical choice for tracking subscription revenue.

However, ARR is actually the standard metric in SaaS since revenue from all types of subscription plans, including monthly, quarterly, or half-yearly ones, can be annualized and added up.

Investors also tend to hone in on ARR when they’re gauging a company’s financial health and determining whether the company is on a promising growth trajectory.

If your business only offers monthly plans, you can simply multiply your MRR by the 12 months in a year to get your ARR so long as extraneous, non-recurring revenue isn’t factored into the equation. If your company doesn’t track ARR, investors might also use this approach to take monthly revenue in your books and multiply that by 12 to get estimated ARR.

If you offer multiple monthly, quarterly, or half-yearly plans for customers, the MRR for each one must be annualized and added up to get your ARR. If you offer multiple annual plans, the ARR for each one must be divided by the 12 months in a year and added together as a group to get your overall MRR.

In many cases, it makes sense to keep track of both your MRR and ARR so you can monitor short- and long-term goals, respectively.

Though you can use your MRR to create ARR projections, these metrics should only measure the amount of revenue coming in from recurring subscriptions and any related add-ons, such as a monthly fee for a premium feature or cost per seat for an enterprise customer.

How to Calculate MRR and ARR

Multiplying your monthly subscription revenue by the number of months in a year seems like a logical way to calculate ARR, but including other revenue sources — as well as ignoring losses that take place — can lead to misstatements and incorrect estimates.

Here are a few quick tips to ensure that your MRR is calculated correctly:

1) Remove revenue generated from one-time events, such as seasonal sales, from your calculations. Not accounting for these events can inflate your MRR and lead to incorrect MRR and ARR calculations.

2) Revenue generated by customers who upgrade their subscription to a more expensive plan or purchase another subscription product can be added to your MRR. From a goal-setting perspective, this can help to offset revenue losses due to churn or downgrades during a month.

Sales initiatives that convince customers to move from their current plan to a more expensive one or to buy additional subscription products — a process known as upselling — can be included in your calculations so long as these upgrades or add-ons are charged on a recurring basis. For example, if a customer went from paying $399 to $599 a month for a recurring plan, the $200 in additional revenue can be included in your MRR calculations.

Example 1: Upselling to a more expensive plan

- A customer bought Product 1.0 and paid $500 per month for the product.

- Customer wants more features, which is usually associated with a more expensive plan, and upgrades to Product 2.0 and pays $700 per month for the product.

- The new MRR from the customer is $700.

Example 2: Buying additional subscription products

- A customer bought Product 1.0 and paid $500 per month for the product.

- Customer wants other products and buys Product AB and pays $500 per month for that product.

- The new MRR from the customer is $1,000.

3) Keep track of how many customers downgrade to a cheaper subscription plan or package. If you offer multiple subscription plans, downgrades in any given month must be subtracted from your MRR for that time period.

4) Consider how churn rates can affect your revenue projections. The fact is that there may be customers who will cancel their subscriptions and stop using your services for any number of reasons. This process, known as churning, must be taken into account when you’re tallying up subscription revenue. Some customers may also ask you to cancel their subscription before it’s due to expire. Regardless of when you let customers churn, their revenue contribution is taken out of your MRR calculations only when the cancellation is officially processed by your company.

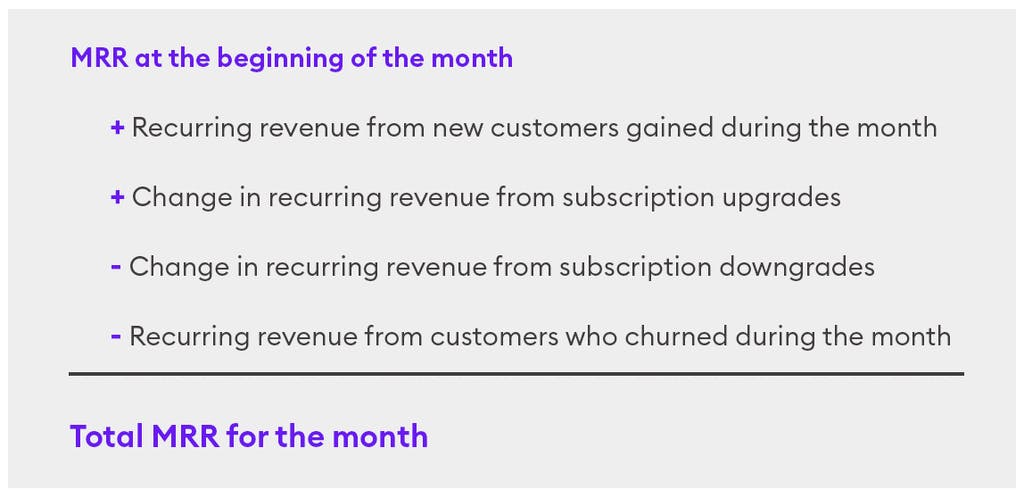

With all of these factors in mind, this is the more accurate formula that should be used to calculate your MRR:

Calculating, tracking, and monitoring your subscription revenue over time can be a time-consuming process, but it’s definitely something that can help you determine whether your sales, customer retention, and outreach efforts are actually paying off.

Without this data, you may find it difficult to identify opportunities for growth or improvement and attract prudent investors who need proof that your business model is in tip top shape.

By adopting a data-driven strategy and leaning on the right team of finance professionals, you help your organization become more agile and have the information that investors need to make informed decisions about your business.

Still challenged by your business’s finance metrics? Pilot’s expert CFO services team can help.