Outsourced Bookkeeping: Everything You Need to Know to Find a Bookkeeper You Love

A confirmation email has been sent to your email.

If you’re ready to move bookkeeping off of your plate, outsourcing bookkeeping services can be a good option—but it can also open up a lot of questions. What services does outsourced bookkeeping actually include? How much does a bookkeeping service cost? Can you get away with just using bookkeeping software alone?

To help you figure out the best bookkeeping solution for your needs, this article talks about:

- The benefits of outsourcing your bookkeeping — versus using bookkeeping software or hiring a bookkeeper in house

- What tasks a bookkeeping service can cover

- How the process of outsourcing your books actually works

- How much you should realistically budget for quality outsourced bookkeeping.

In other words, we’ll cover everything you need in order to make key decisions about outsourcing your bookkeeping.

At Pilot, we have a team of expert bookkeepers (with software superpowers) doing your books in QuickBooks Online. Let us take the bookkeeping burden off your plate: Try Pilot Now!

Does Outsourcing Your Books Make Sense for Your Business?

If you’ve already decided to move bookkeeping off your plate and onto, well, anyone else’s, the benefits are obvious. For starters:

- You don’t have to do it yourself — which means your time and patience are spent on growing the business.

- You don’t need to worry about inaccuracies or falling behind on your books when a pro has it covered.

- When it’s time to raise money or file your tax return, you know your books will be professional, complete, and ready to turn over to a CPA.

But outsourcing your bookkeeping to another company isn’t the only option you have to offload your books. You can also hire an in-house bookkeeper. So what are some of the benefits of outsourcing your books instead of hiring in-house?

- Outsourced bookkeeping is more flexible, allowing you to scale your service up or down as your business needs evolve.

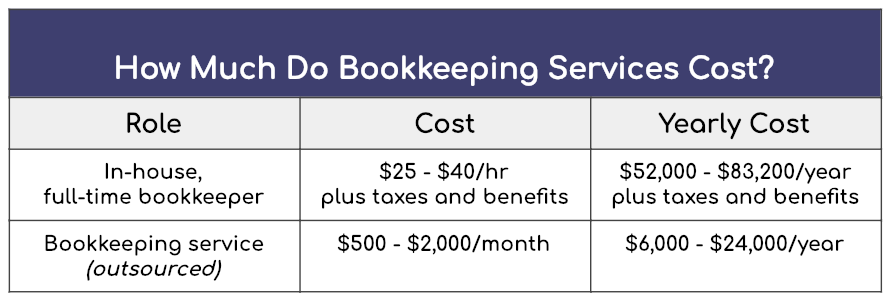

- Many outsourced bookkeeping services are more cost effective (sometimes substantially so) than paying a full-time bookkeeper’s salary plus benefits.

- Someone else handles the vetting and hiring of qualified, professional bookkeepers.

Note: At Pilot, we offer an additional advantage that many bookkeeping services don’t have. On top of QuickBooks Online, we built powerful software to automate the most repetitive and error-prone aspects of bookkeeping. Combined with our expert bookkeepers, you’ll always get a first-class experience — and keep great books. Let us take the bookkeeping burden off your plate: Try Pilot Now!

What services does outsourced bookkeeping include?

What Services Does Outsourced Bookkeeping Include?

As it turns out, there’s a lot of blurred area between bookkeeping, accounting, and taxes. The specific set of tasks your bookkeeper performs can vary from person to person. So if you decide to outsource your bookkeeping, what does that actually cover? What tasks can an outsourced bookkeeping service manage for you?

An outsourced bookkeeper or bookkeeping service can handle any and all of these tasks:

- Importing financial information from your bank statements, credit card statements, payroll records, invoices, and more (and with a bookkeeping service like Pilot, this is done automatically by connecting your accounts and any other financial software you use)

- Categorizing and reconciling those transactions to ensure everything’s accounted for

- Tracking bills and income yet to be recognized (which typically includes accounts payable and accounts receivable management)

- Ensuring your books are always up-to-date and accurate

- Providing you accurate financial statements at month-end — including Profit & Loss (Income) Statements, statements of cash flows, and a balance sheet — on a monthly or quarterly basis

- Explaining those financial statements and other aspects of your bookkeeping in terms you can understand

- Handing complete and accurate financial reporting over to investors, tax preparers, and anyone else who may need access.

You’ll have to hash out the details with the person or service you choose. It’s worth asking questions up front and making sure your expectations are aligned with their offerings before signing up.

How Does Outsourced Bookkeeping Work?

Depending on whether you opt to outsource your bookkeeping to an independent professional bookkeeper, a human-only service, or a hybrid bookkeeping service, the process may look a little different. When you work with a service like Pilot, here’s how the process works:

- Step 1: Your dedicated account manager will work with you to set up integrations and connect all the financial accounts and software your business already uses. From there, the process is reliable and automatic — pulling your financial data from all sources and into (in our case) QuickBooks Online.

- Step 2: The bookkeepers work together with software to record, categorize, and reconcile transactions. Meanwhile, you don’t have to think or worry about your books.

- Step 3: At the end of each month, we send over your clean and accurate financial statements.

Your dedicated account manager is always available to support you and answer any questions you may have, whether it’s about your monthly financial statements or anything else along the way.

Costs of Outsourced Bookkeeping

If you’re hoping for a hard and fast guideline here, this section will disappoint you. Bookkeeping needs and financial situations vary widely for every business, so it’s impossible to give a blanket number that businesses can expect to pay for outsourced bookkeeping. But we can give you a few guidelines as to bookkeeping costs.

In most cases, it’s safe to estimate your bookkeeping costs to outsource will be in the range of $500 – $2,000 per month.

Within that range, your business’ costs will vary depending on the type of bookkeeping support you opt for. Rates hinge on things like:

- Whether the service utilizes software, humans, or both

- The scale of your business’ transactions and expenses (this can be based on the volume of transactions or the dollar amount)

- Whether you’re looking for cash- or accrual-basis bookkeeping

- The number of financial accounts you need to connect

- How frequently you receive financial reports

- The caliber and time investment of support you get access to

- Additional features like accounts payable and receivable, inventory management, and more

- The overall complexity of your financial situation (for example, if you need special revenue recognition or support for multiple entities).

The more complex your situation is, the higher your bookkeeping costs will be — and the more likely you are to need a good bookkeeper.

Outsource Your Bookkeeping to Grow Your Business

Accurate and complete financial books are a must-have for every business — but managing them doesn’t have to eat up your valuable time and patience. If bookkeeping is taking up time you could be spending to grow the business, it’s worth the investment to move the back office off your plate.

Outsourcing bookkeeping allows you to be confident in the accuracy of your books and get back to doing what you do best.

At Pilot, we have a team of expert bookkeepers (with software superpowers) doing your books in QuickBooks Online. Let us take the bookkeeping burden off your plate: Try Pilot Now!