Pilot R&D Tax Credit: How It Works

A confirmation email has been sent to your email.

One of the services we offer at Pilot is help in claiming the R&D tax credit (and in fact we’ve helped our clients save tens of thousands of dollars each, by doing just that). A common question from companies that are looking into the R&D credit is, how does all this work? How will Pilot help, and what can they expect from the process?

We’re here today to shed some light on what to expect.

What is the R&D Tax Credit?

First, some context. The R&D tax credit was introduced by Congress in the 1980s to encourage American innovation, by allowing companies who undertook US-based research to offset their income taxes. The credit was later expanded in 2016 to allow businesses to claim it against payroll taxes as well – which opened the door for not-yet-profitable startups to receive tax benefits for their R&D work.

Eligibility

To be eligible for the R&D tax credit, your company must conduct qualified research activities in the US. You can then claim the credit for certain expenses that you incurred while doing your research.

There are a number of restrictions on which research and expenses are considered qualified by the IRS (which we cover in more detail in our guide to the R&D tax credit). At a basic level, however, your research must meet the following requirements to qualify:

- Solve for an uncertainty

- Involve a hard science

- Develop new & improved hard science products

- Involve a process of experimentation

These requirements are also called the Four-Part Test, which is the key way the IRS evaluates eligibility for the R&D tax credit.

Required Forms

The primary form for the R&D Tax Credit is IRS Form 6765. You’ll use this form to report your qualified research costs, and if you intend to calculate your credit using the regular credit or alternative simplified credit (ASC) method.

If you intend to claim the credit against your payroll taxes, you’ll also need to provide information about your income tax returns in IRS Form 8974. You’ll then need to take the information from Form 8974 and enter on IRS Form 941, which reports the payroll taxes withheld from your employee’s paychecks. You’ll send both 8974 and 941 to the IRS.

Required Documentation

You’ll need to have clear, preferably contemporaneous financial and technical records for all of the expenses included in your claim (this is commonly referred to as an “R&D Study”). These records should indicate what each expense was for, how it relates to your research, and why it’s qualified.

The documentation aspect is crucial, because the technical component of the R&D credit is just as important as the financial one. You’ll need to demonstrate technical qualification against the Four-Part Test mentioned earlier, and clear reasoning as to how and why your research qualifies as new and improved R&D

The R&D Process with Pilot

Once you start the R&D credit tax prep process with Pilot, there are three main steps to getting you your credit.

Step 1: The Interview

The first thing our team will do in the process is set up a brief interview call with you to learn more about your business and your research. The purpose of the interview is to get a deep sense for your R&D activities, and what might be eligible for your R&D credit claim.

This takes more time than the self-serve questionnaires that some providers offer (which also make the customer do all the work!), but we think it’s time well spent. While “research activities conducted in the US” sounds straightforward, there is a considerable amount of nuance around what does and doesn’t qualify.

Rather than asking you to try to make that determination yourself, our expert team digs in and uncovers any issues that might be relevant to your claim (and any opportunities you may have missed). Since our team has been through the R&D claim process many times in the past, they know which questions to ask – and how the IRS will interpret the answers.

Step 2: The Report

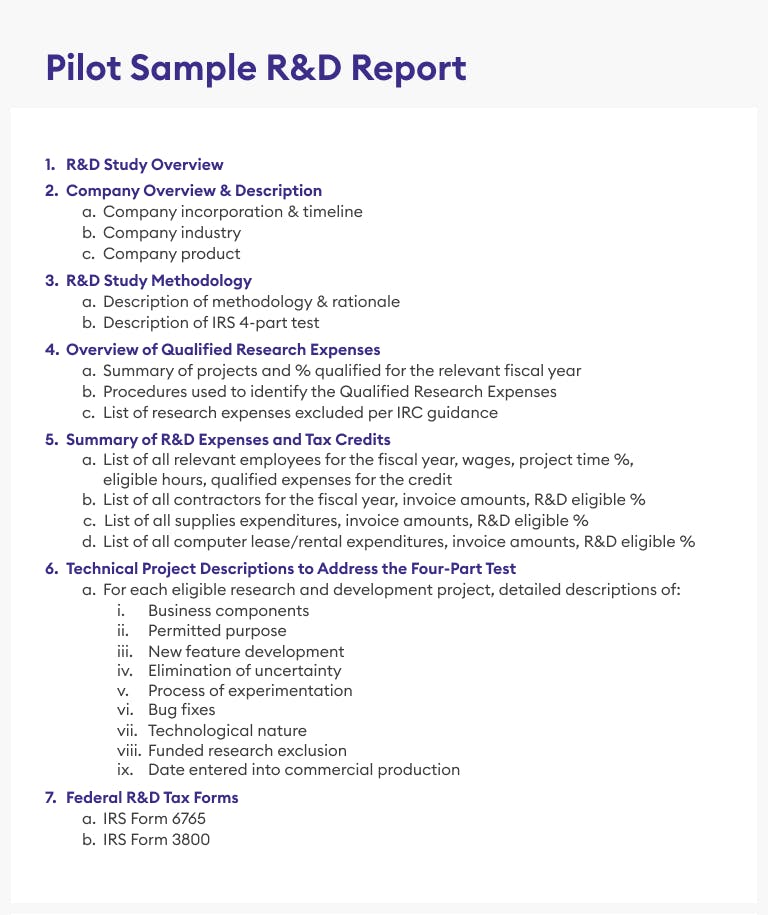

The most important piece of any R&D tax prep service is the R&D Study. This is a report that contains all the evidence and documentation necessary to substantiate your claim in case of an audit.

One of the advantages of choosing Pilot for your R&D tax prep is that we produce one of the most comprehensive and audit-ready R&D Study documents on the market. Our team also handles 100% of the work in assembling the documentation. This is not true of many providers, which is why it’s a good idea to always ask a potential provider for a sample R&D report so that you know what you’re getting (you should also ask them to explain what they’re responsible for vs. what you’re responsible for, as this is another thing that varies between providers).

The final R&D Study report is an in-depth accounting of your company and its business, your research activities and how we assessed them, all eligible expenses with documentation, and a detailed technical explanation of how your research meets each part of the IRS’s Four-Part Test.

Besides simply that we do the work for you, a benefit to working with Pilot on this is that our team is highly experienced, with both the tax and the technical know-how to do it right. Pilot’s experts have been through a lot of audit cycles over their careers, and they know how to build your report so that it will hold up to IRS scrutiny.

Besides just tax expertise, our team also includes people with a technical background to help ensure that all claims are actually supported by your activities and documentation. One of the challenges of the R&D credit is that it requires both knowledge of the tax system and enough familiarity with technical subject matter to avoid misunderstanding what a company actually does (and thus what it might qualify for).

The end result? You get a report you can be confident about, with everything you’d need to show the IRS in an audit.

Step 3: The Forms

The forms for claiming the R&D credit can be confusing, particularly with multiple options for how to calculate and apply your amount. We’ll fill out these forms for you, according to the information from your report, and also coordinate with your tax preparer to make sure they’re filed correctly.

The Results: What to Expect

Since Pilot began offering R&D tax credit services, 100% of our clients who have applied for payroll offsets have received their money. If we go through the process with you, it’s because we’re confident that you qualify to receive the credit – and you can be confident about that too.

Due to the high value of the R&D credit, it’s unfortunately also popular with scammers (so much so that the IRS added it to the Dirty Dozen). Even for legitimate tax preparers or CPAs, the complex requirements and necessary technical understanding means it’s easy to make mistakes. A tax preparer who doesn’t have a background in software engineering, for example, may not be able to accurately assess if a company’s code really is new and improved (and thus qualified), or if it runs afoul of some of the many technical disqualifiers.

As a result of the number of unqualified claims (both accidental and intentional), the IRS pays extra attention to tax filings that include the R&D credit. Because of this, even the best-prepared R&D claims carry an increased risk of audit.

If you do get audited, you’re not on your own. Pilot will help you defend your claims to the IRS, and your comprehensive R&D Study will help prove that you’re qualified for what you claimed on the credit.

The R&D tax credit is a valuable tool to save money on your tax bill (that you can then reinvest in your business!). With Pilot, you can get peace of mind in knowing that you’re claiming all that you’re eligible for – and that you’ve got the audit-ready documentation to prove it.

To learn more, visit our R&D Tax Credit page, or get in touch to schedule a 1:1 call with one of our specialists.