Startup Stories: Lessons Learned From Winding Down Cherry

A confirmation email has been sent to your email.

When Gillian O’Brien co-founded Cherry with her sister Emily, she was ready to disrupt the HR space with a modern employee perks platform. The Cherry team was encouraged with their initial success—joining Y Combinator, raising a $700k+ angel round, and acquiring 40+ paying customers.

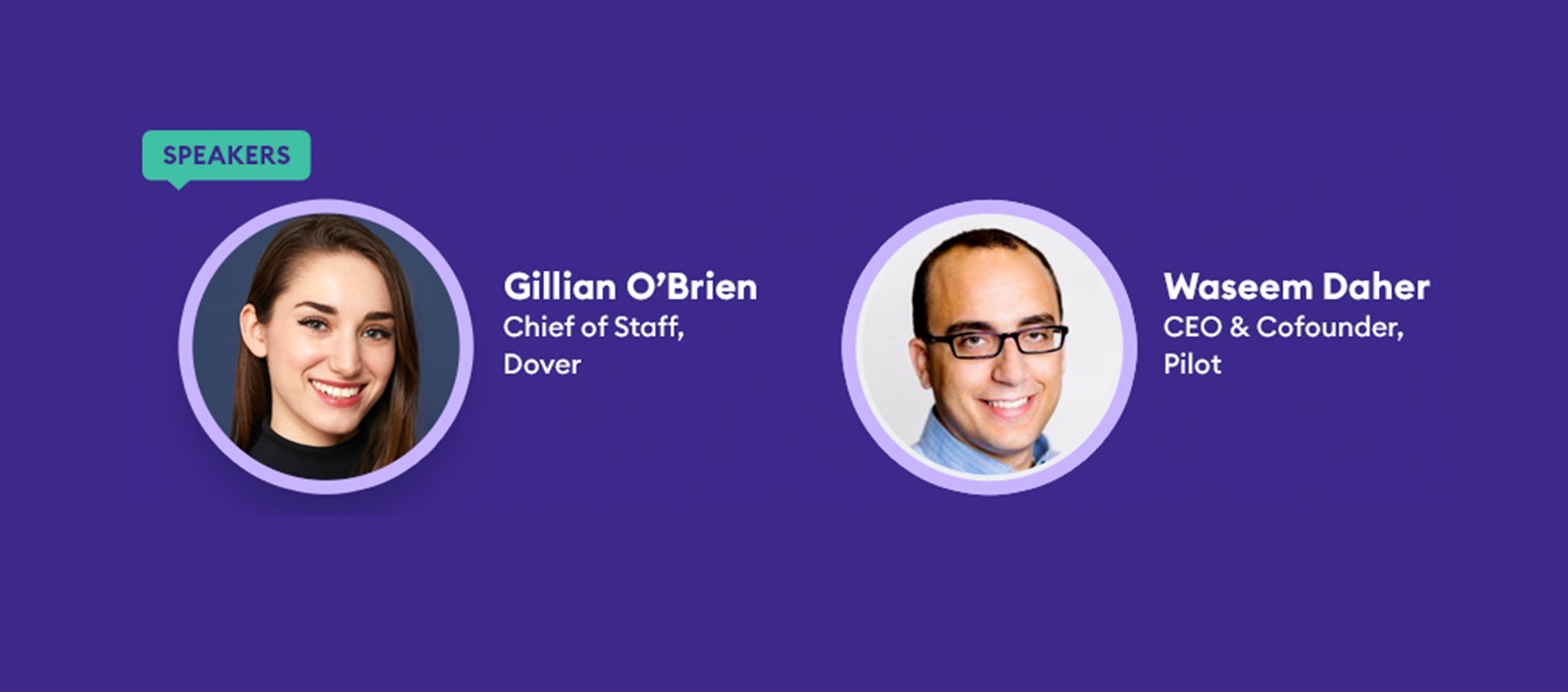

However, after an unsuccessful attempt to raise a Seed round during COVID, they made the difficult decision to wind down Cherry. Gillian recently sat down with Pilot co-founder and CEO Waseem Daher to discuss Cherry’s journey and what she learned along the way. Read excerpts from the discussion below, and watch the entire 38-minute interview here.

On the biggest challenge as a first-time founder

Waseem Daher:

So as we mentioned, you took Cherry through YC. What were some of the biggest challenges for you folks coming out of Y Combinator?

Gillian O’Brien:

So our number one challenge was, so I was going to say fundraising, but it was also just, I think there are so many challenges to being a first time founder just in not knowing what you don’t know and just such a lack of context. I think for me, especially not really having any connection to the tech industry up until the point that I became a founder, there was just so much to learn. And I think because we felt like novices and amateurs in a lot of ways, we tried to learn as much as we could or rely on or lean on the advice of other people and experts. And that ended up not being a very good strategy for us and so I think coming out of YC we thought, yeah, fundraising is going to be super easy because everyone is telling us that there’s so much money right now and people are just throwing it at founders. Just pitch it like this and just say that, and it’ll all be really easy. And it was not [easy] at all.

And I didn’t feel like I knew anything about pitching investors or how those dynamics are. I wrote about this in the article that I published about our fundraise, but the money that we were able to secure I think was just pure energy that I was bringing to the conversations… it was just sheer blunt force basically, and not actually that much to do with being strategic and calculated and thoughtful. And we just didn’t really have a strategy for raising money, and so looking back I think we did a lot of things wrong and there are things that I really only learned were wrong in the aftermath and having now built out the context that I have. So I’m not sure if there was really any way to avoid those hard lessons, but yeah, just being a first time founder and not having that much context on the industries is pretty tough.

On the decision to wind down

Waseem Daher:

So what was your thought process in this? There was some investor interest, there was some acquisition interest, it sounds like those didn’t pan out. How did you make the call of like, “Okay, it’s time to wrap this thing up.” Talk to us a little bit about how you went about that process?

Gillian O’Brien:

So I think this was another moment for us that was important to not listen to some of romanticized or glamorized stories about founders and startups, because I think there probably was one side or one perspective that would have pushed us, like, Hey, just…

Waseem Daher:

Just keep doing it.

Gillian O’Brien:

Yeah, exactly. Go into zombie mode or just offboard all your customers and use the remaining money and just ride it out or even… there are some people that would even suggest like, “Just go into debt, just sell your belongings, just do whatever you need to do.” That’s not… some people, I think, that’s what they do and that ends up working out really well for them. I think that for us, we just wanted to have a lot of integrity about our customers.

We felt like they had really taken a chance on us and really been super supportive throughout our experience and helped us learn a lot of things, and were available for conversations and gave us feedback. We didn’t want to screw them over and so we thought that it was more important to shut down gracefully and give people notice and help them off-board and go find other solutions and be part of that process.

And so for us, that was the most important thing. And I think we also wanted to be able to give money back to investors and also wanted to be able to help other founders by sharing what we had learned. So those were the things ultimately that were the most important to us that helped guide that decision rather than thinking of all of these other ways that we could potentially survive. I think we had been in a survival mode for long enough and felt like, it’s not really working for us. So it’s better to close the doors in a really graceful way, that was our priority.

On conventional wisdom and harmful advice

Waseem Daher:

I would love to talk about some of the worst advice you got or places where you thought the conventional wisdom actually was either wrong or maybe even worse, was pretty actively harmful.

Gillian O’Brien:

Yeah. So one of the first things that I think for us ended up not necessarily being great advice, was just like speed, speed is everything, go fast, move fast. We did that and we rushed to create this MVP and then just launch it and sell to just whoever. And that was a way for us that we got traction, and then we were able to present traction on [YC] Demo Day, but it screwed us over just in, okay, now we’re tied to maintaining this MVP that is not good, not scalable. And to having these customers who… are these our customers? Are they the best customers or is this the customer base that we want?

We didn’t have the time to be thoughtful about that and I think that ended up being when we had that “screw it” moment and started being more thoughtful about [letting] our wisdom or our ideas guide us. That’s when we had the moment of, let’s just slow down. Let’s sunset this product, off-board these customers, think about who we do want to work with, and think about what our ultimate dream and vision of this product is. And just focus on that and not put something out the door that’s not ready yet. So yeah, that’s one of the first things that comes to mind.

And then of course, I just think that the general advice of “Fundraising is going to be easy, don’t think about it. Don’t worry about it. As long as the product is good, as long as the traction is there, you have nothing to worry about.” I feel like that’s just not true and fundraising, although I think founders hate it and they think it’s a distraction, it is this very necessary part of your business, if the venture route is the one that you’re going to take. That in and of itself is its own whole skill and something that does deserve a lot of preparation and attention and focus.