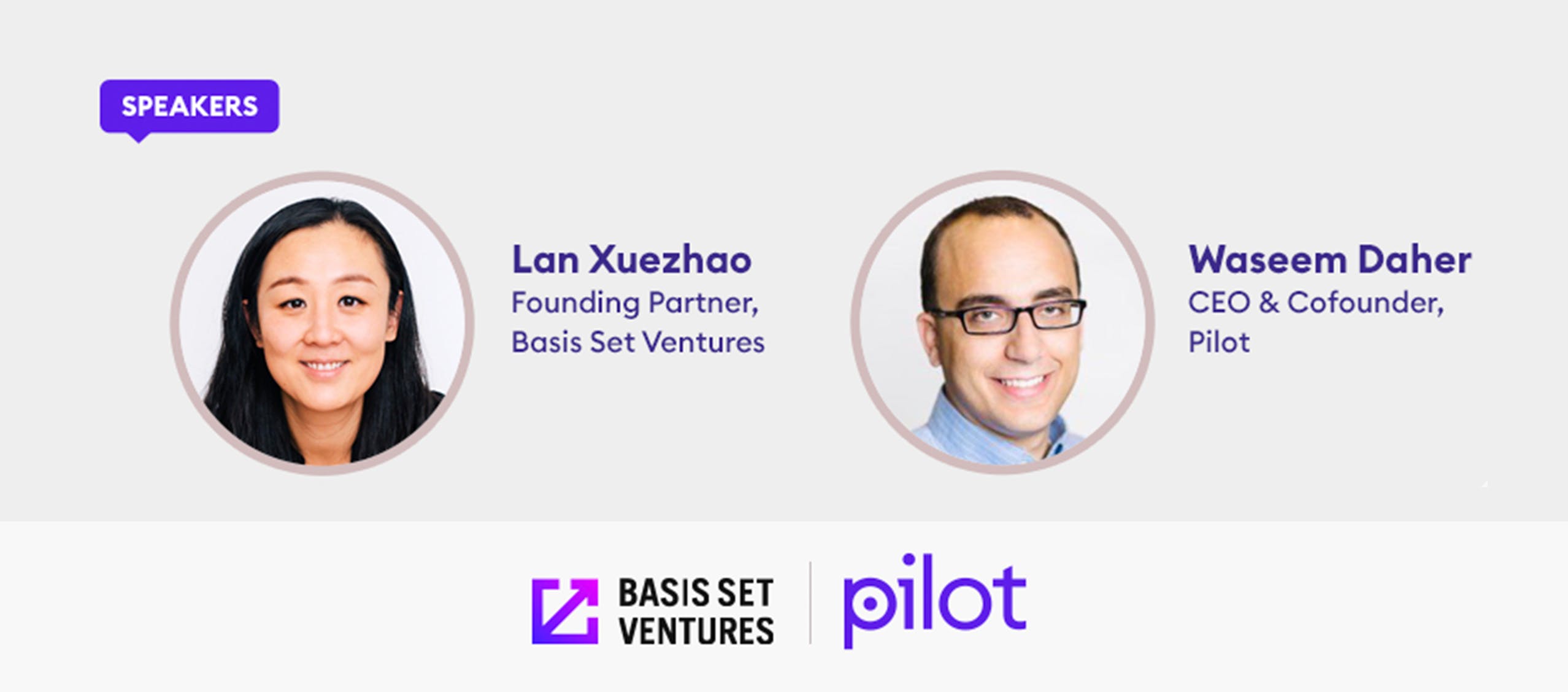

VC Fireside: Lan Xuezhao of Basis Set Ventures

A confirmation email has been sent to your email.

Dr. Lan Xuezhao founded Basis Set Ventures in 2017, after previously leading the Corporate Development Strategy team at Dropbox. In Lan’s words, Basis Set Ventures is “a seed-stage venture fund investing in artificial intelligence companies, specifically those focusing on changing the way people work.”

Lan recently sat down with Pilot CEO and co-founder Waseem Daher to talk about why she founded the fund, what she looks for in early-stage companies, founder mistakes she sees most often, and more.

Read excerpts from the discussion below, and watch the entire 45-minute interview here.

On What She Looks For In Investments

Waseem Daher:

As you look for companies in the early stage and as you look for founders in the early stage, what are the criteria you use to evaluate “is this an investment I want to make” or “is this a team I want to back?” How do you think about that question?

Lan Xuezhao:

At the high level, it’s really very simple. You want to find a big market. You want a really strong team. You want a great product and strong tech, right? The devil’s in the details. What makes a strong founder? What is a big market? How do you decide this is a great product, right? That’s really the most difficult part. I can spend all day talking about this.

Let’s maybe dig in on the founder a little bit. We’ve done quite a bit of research on actually understanding what makes a strong founder. Every investor wants to invest in a strong founder, but if you talk to every investor, everyone has very different opinions. For example, people anchor on the founder, Mark Zuckerberg or Jeff Bezos, some of the celebrity founders, and say, “We’re going to invest in someone who is very technical, dropped out of MIT or Harvard, building very technical products.” Those are really kind of, in our view, very superficial qualities of founders that tend to misguide investment decisions.

Where we try to spend a lot of time is really to dig into the fundamental driver as a founder. Are you really strong in execution? Do you have customer empathy? Can you quickly iterate with customers, and find out what they really want, and build that for them? How fast do you iterate? The learning curve, the growth mindset with execution, and customer empathy, I think these are the three most important things a founder can have.

On Types of Founders

Lan Xuezhao:

If you go to our website, we have founder segmentation. We think every founder can be successful, just in very different ways. There’s the segment that we call a humble operator. By the way, we collect a lot of data, and this is statistically modeled out. The humble operator founders are those who are super strong in execution, may or may not be the most charismatic when presenting to VCs. There are actually a lot of founders, really successful ones built in this way. They’re just not the type who just really win you over in one meeting, but they’re still very, very successful founders.

The second type is what we call agile visionary. These are younger founders, but it’s really not the age that makes them different. It’s that they’re really visionary. They’re very multifaceted. They learn super fast. They can be empathetic to customers and build things really fast. These are two examples. We have four more examples. Some are successful. Some are not. We try to be unbiased when looking at founders, really looking at their qualities versus their credentials, their age, whatever other attributes people tend to use. That’s on the founder side.

On Common Founder Mistakes

Waseem Daher:

Are there mistakes that you commonly see early-stage founders make, whether these are founders you fund or maybe founders you don’t fund? Are there common things you’ve seen across the portfolio?

Lan Xuezhao:

Yeah, I think the first thing in fundraising is about founder-investor fit. A lot of founders will take names or take recommendations from people on the internet, from friends, and you really go approach these investors and waste a lot of time. When I raise my fund as a fund manager, it’s also about VC, LP fit. I don’t talk to more than even 40 people, which is really not many, but the fit is really important. You know with some people, it doesn’t matter how much time you spend, they’re just not going to invest, right? So a lot of founders waste a lot of time talking to people who are never going to invest for whatever reason. The most valuable resource for an early-stage founder is your time. If you are able to allocate your time intelligently, I think there’s a lot more you could get done. I think that’s number one.

The number two thing, which is also really important… I see founders sometimes having flat growth or no market pull and say, “I’m going to go hire a growth person. I’m going to go hire a marketing person, a first salesperson, and my company will start growing.” It never happens that way. If you don’t have market pull, your company doesn’t grow. It’s most likely a lack of product/market fit. The founders will need to really go figure out, “is the product I’m building, is the messaging I’m sending, right?” [Figure out] what actually needs to happen for this to start growing, versus hiring a growth person. A growth person will not solve your problem of lack of product/market fit. I think that’s number two.

Number three is a lot of times founders either burn too fast or burn too slowly. Especially in the age of COVID, everything changes so fast. We have a bunch of companies that had unprecedented growth driven by COVID and a few companies who actually their business has completely changed. Their market segment completely changed. So this is a time that’s really important for founders to learn super fast and keep an open mind about “what is the first principle” thinking. Forget the best practice of how you should do a certain thing. Really understand why that’s the case, and start from the first principle, and then apply that to that business today, which could be very different from even last week or last year.