Annual Budgeting Guide for Startups

A confirmation email has been sent to your email.

Autumn is upon us once again, and that means it’s time for three things: shorter days, pumpkin flavoring in everything, and figuring out next year’s budget.

If you’ve never made a business budget before (or if your business has gotten significantly more complicated than last year), it’s not always clear what to do or where to start. To help you get going, we’ve put together a quick guide to annual budgeting for startups.

The Goals of Your Annual Budget

Before we get into the execution, let’s take a moment to talk about the why. What is the purpose of the annual budget, and why is it important?

- Don’t run out of money. Let’s get the obvious out of the way: you’re making a budget so that you can avoid running out of cash. Besides just creating a plan to spend within your means, your budget tracks what you’re actually spending, so you can take action if things veer off course. This is definitely one of the primary purposes of your budgeting process – but it’s not the only one.

- Get visibility into where your business is headed. An annual budget is a planning exercise. In order to put together your budget for the year, you have to figure out where you expect to be as time progresses. Besides just avoiding overdrafts, this means planning for future growth and business changes.

- Identify what’s driving your business. To effectively plan for the future, you need to understand what drives your outcomes. Working on your budget should prompt you to examine your business indicators and how they affect results. Examples of revenue drivers might be website traffic or sales leads – as they go up, your revenue might go up along with them.

- Identify what you can adjust to get results. When you’ve determined what your business drivers are, you can apply that knowledge in your budget to develop different scenarios based on those variables. How would things change if you added spend to an area that boosts a key driver? How would they change if you had to reduce spending instead?

Besides just avoiding a cash crisis, your budget is an important tool for answering these questions and helping better understand your business.

What to Think About Before You Start

Since your budget is for the entire upcoming year, you’ll need to forecast how you expect your business to perform for the next twelve months. That’s why when you sit down to start your annual budgeting process, it pays to carefully think through your plans for the upcoming year, and how they might affect your income and spending.

- Upcoming business changes. While sometimes life throws you (or the entire world) a curveball, odds are you have a pretty good idea of what you intend to do over the next year. Are you planning to launch a new product? Make some new hires? Move to a new office (or even go full-remote?). All of these things will have an impact on your budget, whether it’s anticipated income from a launch or anticipated expenses from new headcount or changed rent. Your annual budget plan should reflect your expectations for what that impact will be.

- Profitability and margin goals. If your company is bringing in revenue (or you plan to start making revenue this year), you probably have targets you hope to meet for your margins. Likewise, if you’re hoping to become profitable (or already are!), you know you’ll need to maintain a certain margin to stay that way. Keeping these margin needs in mind as you work on your annual budget lets you work backwards from those goals to see what you need to do to achieve them.

- Fundraising plans. Whether it’s raising a round or taking out a business loan, fundraising expectations will have a big impact on your available resources. When preparing your budget, you’ll want to take into account how you intend to allocate the new funds – and also what your spending might look like if fundraising takes longer than planned.

Asking the right questions before you start is key to a successful budget. Make sure you’ve covered everything with our free Annual Budgeting & Forecasting Checklist.

What Goes Into Your Budget

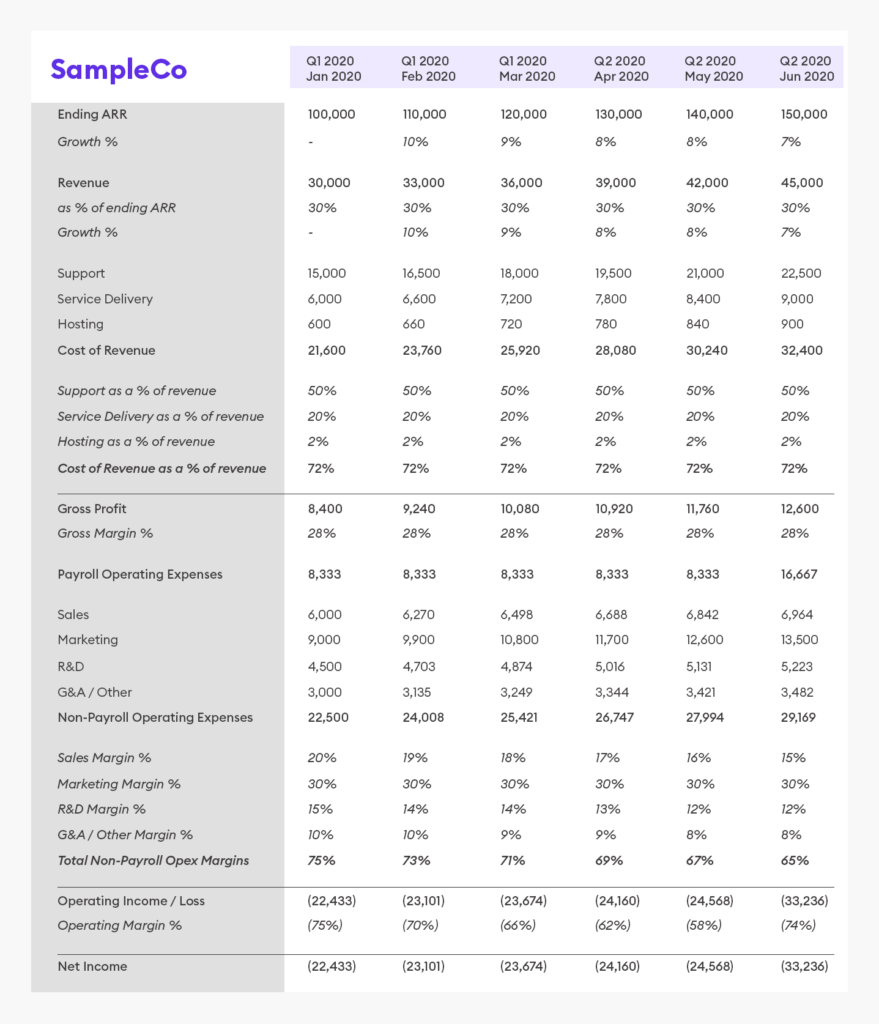

When you start actually assembling your company’s budget, there are essentially two parts of the equation: inflows (the amount of money you expect to bring in) and outflows (the amount of money you expect to spend, whether it’s on creating the product or day-to-day operations). The end result might look something like this:

Let’s take a deeper look at what each section means.

Revenue. This is your company’s income. Usually this means money from sales, though if you have income from other sources (rent from property your company owns, licensing royalties, etc) that money will be included here also.

If your business sells subscriptions or services, you should also include your annual recurring revenue (ARR). This is the amount of money you receive from your subscription contracts, divided by the length of the service contract. For example, if a client buys a 3-year subscription from you for $6000, your ARR for that client would be $2000 ($6000 divided by 3 years equals $2000 per year). While this does not directly go into your financial statements, it’s a great KPI to keep an eye on if you’re a SaaS business.

Cost of Revenue / Cost of Goods Sold (COGS). This accounts for how much you had to spend to create your product or service. For companies that sell physical products, raw materials and labor costs are considered part of COGS; for companies that sell software or services, COGS include any costs directly associated with providing the software or services to your clients, such as the cost of hosting servers. Note that promotion costs like sales and marketing are not included in COGS – these will be accounted for elsewhere.

Gross Profit. This is the amount you make in profit from your sales, before any other costs or expenses are added in. To calculate it, subtract your COGS from your revenue. The amount left over is your gross profit.

While your actual profits will be lower (due to additional costs like operating expenses and taxes) , gross profits are useful for determining how efficient you are at creating your product. If your gross profits are low, it’s a sign that you might want to investigate ways to lower your COGS or increase your revenue.

Payroll Operating Expenses. This category covers any expenses related to paying your employees. Besides just salaries, this includes health insurance, PTO, payroll taxes, and the costs of any other benefits you offer your employees.

Non-Payroll Operating Expenses. Any money you spend normally running your business that isn’t related to employee compensation is listed under this category. This includes everything from rent and utilities to marketing and R&D costs.

Operating Income/Loss. This is one of the most important lines on your budget: the one that tells you if your normal business operations are making or losing money. To get this number, subtract your total operating expenses (payroll + non-payroll) from your gross profit. If the number is positive, your business is overall generating income. If the number is negative, then you’re operating at a loss.

Most startups aren’t profitable until after several years, so an operating loss here won’t be a surprise. This number is still valuable, however, because it allows you to understand how your company is currently operating (and track if it’s following your plan).

Net Income/Loss. This is your total income or loss, after all expenses have been subtracted from your gross profits. If you don’t have any additional costs outside of your operating and capital expenses, this might be the same as your operating income/loss. If you do (for example, if you owe state franchise taxes), your net income will be your operating income, minus those remaining expenses.

Note that this is not necessarily your “cash burn,” because the financial budget (especially if your books are done on an accrual basis) does not reflect the exact inflow and outflow of cash. The timing around when your customers pay you and when you pay rent, for example, can all contribute to your actual cash burn.That’s one of the reasons why annual prepayments can be so helpful for startup cash flows.

Unsure on how accrual books work? Get the details on cash vs. accrual accounting.

How to Get Your Budget Numbers

So now you know what to plug into your budget, but where do those numbers come from?

Using Your Financial Statements in Your Budget

Your business’s financial statements are your starting point to get the data you need to build your budget. Each statement provides different information to help you:

- Your balance sheet tells you the state of your business at a specific point in time. It lists how much your company currently owns in assets, as well as your current liabilities (money you owe for things like credit card payments, outstanding invoices to vendors, etc). This is a useful jumping-off point, as you figure out where you want the business to go from here.

- Your Profit & Loss (P&L) statement, also called your income statement, shows you how much money your business brought in (and spent) during a certain period of time. It’s useful for examining your business’s trends, which can help you anticipate what might happen next.

- Your cash flow statement shows you the cash inflows and outflows of the business (as we’ve alluded to above). This is useful for determining your actual cash incomes and examining your current spending patterns.

Budget Forecasting

Guessing the future is always tricky, and it’s rare for anyone to get it 100% right. What you can do is take steps to make an especially-educated guess.

- Use the best data you have available. Use your financial statements as we discussed above, and if you have any historical data available, use that as a source of possible trends. If you don’t have any historical data, that’s ok too – everyone has to start somewhere, and next year you’ll have more to work with.

- Examine trends, and think about what’s changing (or not). Looking at the data you have available from your financial statements and any other sources, you may see trends emerge – maybe you’ve been steadily increasing sales at a certain pace, or maybe your expenses in a certain area have been consistent. Once you have a trend, the next thing to ask yourself is if there’s any reason to think that will change. If there isn’t (for example, if you aren’t planning to hire more sales reps, or you don’t expect to change your spend in that area), then you can reasonably assume your numbers will remain the same or similar.

- Use your trends to estimate the effect of change. If you are planning big changes, you can use the trend data to try to extrapolate the impact. For example, if you have two sales reps and make an average of 10 sales per month, you might estimate that hiring a third rep will increase sales to 15 per month.

Get Help If You Need It

Annual budgeting is a complex task, even for experienced business owners. Getting expert guidance can make a big difference in how effective your budget will be, and how quickly it comes together. If you don’t have a background in finance, it can be worth it to get help from someone who does.

This doesn’t have to mean making an expensive senior finance hire. Many financial service providers, including us at Pilot, offer outsourced CFO services that give you access to an experienced CFO when you need it. Working with a fractional CFO is a cost-effective way to get expert input on what’s important to your business, and how to construct a budget that will help you grow.

Still not sure where to start? Pilot can help. Learn how we get you accurate financial data with high-quality books, and expert CFO guidance on what to do with it.