How to Read a Balance Sheet

A confirmation email has been sent to your email.

Your business’s balance sheet is an important tool for understanding its financial health, and getting the information you need to make successful business decisions. In this guide, we’ll go through what a balance sheet is, how it’s used, how to understand what it’s telling you, and how to use that information in running your business.

What is a balance sheet?

The balance sheet is one of the three financial statements, along with the P&L statement and the statement of cash flows. It represents a specific point in time (for example, the balances on December 31, 2020), and shows three categories of information: assets, liabilities, and equity.

- Assets are things that your company owns. This includes cash in your accounts, as well as fixed assets like equipment.

- Liabilities are things that your company owes others. This includes things like credit card debt and vendor bills. Tax obligations can be included here as well.

- Equity is the difference between the two. If your company suddenly sold all assets and paid off all liabilities, equity is the amount that would be left over.

How to Read a Balance Sheet: Example

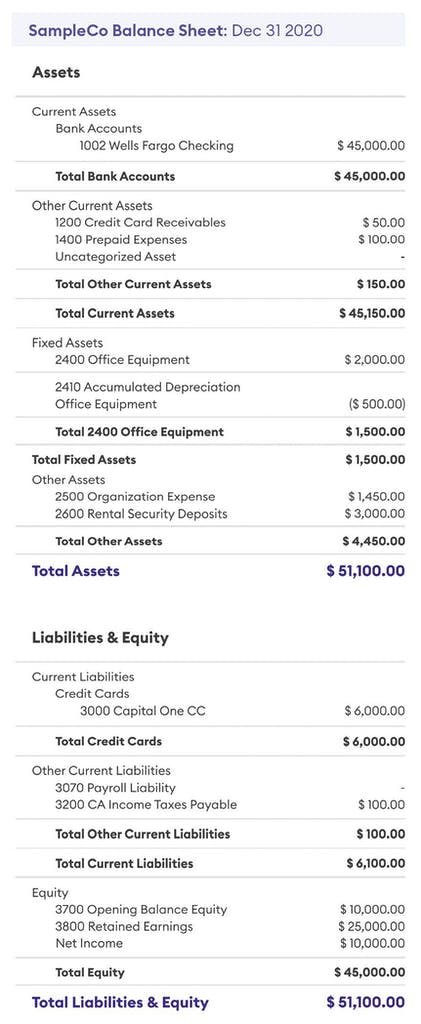

Below, we have an example balance sheet for SampleCo:

Assets

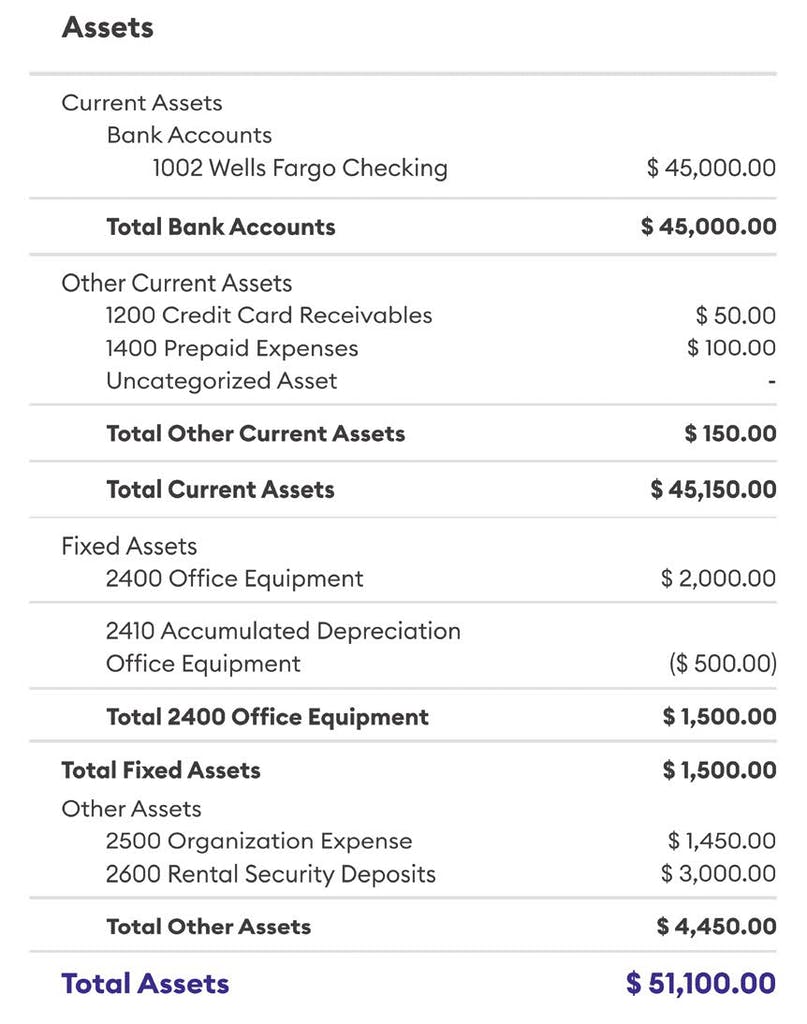

Assets are listed in the first section. This represents everything that SampleCo currently owns.

Looking at our example, we can see there are also several subcategories of assets. The first is current assets. These are assets that the business expects to convert into cash within a year – for example, inventory that an ecommerce retailer intends to sell. The current assets category also includes cash that the business has on hand.

In our example, we can see that SampleCo’s largest asset is the cash in its bank account, at $45,000. Its current assets also include a $50 customer credit card payment that’s still processing, and $100 worth of goods or services that SampleCo has paid for but not yet received.

The next asset category is fixed assets. These are assets that SampleCo uses to operate their business (in this case, office equipment). Other possible examples might be factory equipment for a manufacturing company, or vehicles for a transportation service. Because fixed assets usually lose value over time, the balance sheet factors in depreciation when it shows these assets. In this case, we can see that SampleCo’s fixed assets are worth $1500 after depreciation.

We also see some less obvious assets. SampleCo’s Other Assets lists organizational expenses, which are expenses it paid to incorporate, and the rental security deposits it paid to its landlord. It may seem counterintuitive that these are included in the assets section, since this is money that SampleCo has paid out, rather than money coming in. The reason they’re included here is that SampleCo now owns the value of these things – in this case, being an incorporated business, and a cash deposit that will presumably be eventually returned.

At the bottom of the assets section, we have the grand total: SampleCo owns $51,100 worth of assets.

Liabilities

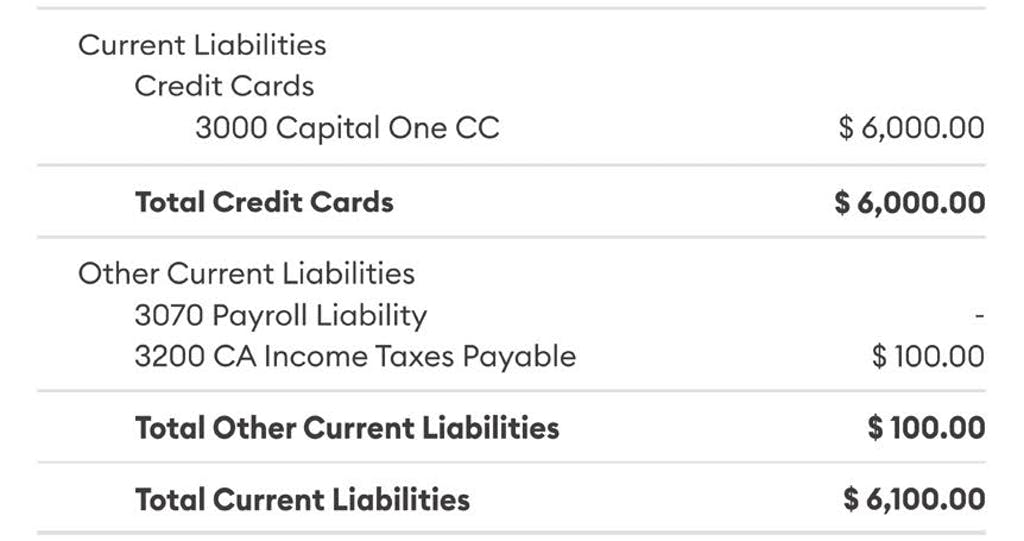

Below the assets, we find the liabilities. This is the money that SampleCo currently owes to other entities. Just like in the assets section, liabilities fall into several subcategories.

Current liabilities are debt obligations that the company needs to pay off within a year. This can cover anything from large debts like bank loans, to small, temporary debts like unpaid bills and credit card expenses.

Looking at our example, we see SampleCo currently owes $6000 in unpaid credit card charges to Capital One. It’s important to remember that this is the balance on the credit card the day that this balance sheet was generated. A balance sheet generated a few days later might show a different number here, if SampleCo makes additional purchases (or pays off the card).

Below the credit card section are SampleCo’s other current liabilities. In this case, there is only one additional amount that SampleCo currently owes: $100 for income taxes. If SampleCo had any unpaid bills to other vendors – subscription charges to a SaaS provider, for example, or fees for a cleaning service – that amount would be listed here also.

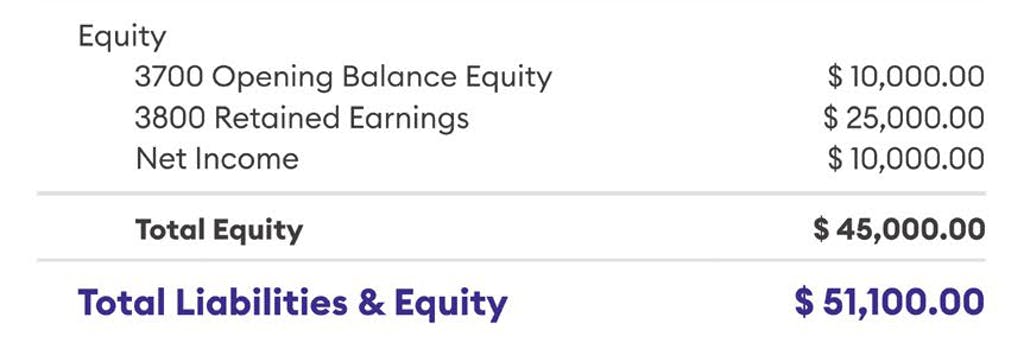

Equity

Finally at the bottom, we have equity. As we’ve discussed, this is the money that would be left over if all assets were sold and all liabilities paid off. This section is also sometimes called owner’s equity or stockholder’s equity, since that money would then go to the company’s owners. In order for a balance sheet to balance, the total amount of assets must equal the total amount of liabilities + equity.

Since we’ve already established that SampleCo has $51,000 in assets and $6,100 in liabilities, we can arrive at the equity through simple math. Assets ($51,000) – liabilities ($6,100) = equity ($45,000). If SampleCo closed down and liquidated the day the balance sheet was generated, there would be $45,000 in cash after paying all its debts.

What is a Balance Sheet Used For?

The balance sheet is often described as a snapshot of your business, because it captures the state of your finances at a single point in time. You can use it for an at-a-glance look at some key indicators for your business’s health.

- Debt vs. Income. The liabilities section clearly shows what unpaid debt obligations your business currently has, while the assets show the financial resources it has available. If the liabilities significantly outweigh the assets, it’s a warning sign that a business might be at risk for paying its bills.

- Liquidity. If a business needs to make a payment on a short timeline, how easily can it get the money? The assets on the balance sheet can tell you. In our example above, SampleCo has great liquidity; its biggest asset is the cash in its bank account.

Imagine a different scenario, however – maybe a business owns a lot of valuable machinery, but has little cash on hand. Even though that business’s total assets might be worth a lot of money, by examining the balance sheet details you would be able to see it had low liquidity. Like debt vs. income, this can be a warning sign about the overall health of the business.

How the Balance Sheet Works with the Other Financial Statements

The balance sheet works with the other two primary financial statements to give you a more complete view of your business’s finances.

The P&L Statement

Your Profit & Loss statement (also called an income statement) covers money coming in and money going out, just like the balance statement. The key difference is time. If the balance sheet is a snapshot, the P&L statement is a trendline, showing you your business’s revenue and expenses over time.

Your P&L statement puts your balance sheet in context. Is your business currently performing better or worse relative to the rest of the period? (It can be helpful to compare to older balance sheets for this information as well).

The Statement of Cash Flows

The balance sheet and the P&L statement show income and expenses according to your recorded transactions. For businesses using accrual accounting (which is to say, nearly all of them), this means the numbers on the statement don’t necessarily reflect the actual cash in the bank. For example, if your business made a large sale, but the customer hasn’t yet paid, the money from that transaction would be shown as income – even though your business doesn’t actually have that money yet.

The statement of cash flows is the report that shows your actual cash status. Comparing it against your balance sheet shows you how well your transactions match up with what’s in the bank. For example, if your balance sheet shows significantly more cash than is in your accounts, you may need to consider how you collect from your customers.

The balance sheet is one of the key tools available for understanding the health of your business. Keeping a close eye on it, and the other financial statements, helps ensure that you’re making the right decisions for your company – and avoid any surprises.

Not sure what to do with your financial data? Pilot can help.